6 Facts About Inflation Every Investor Should Know

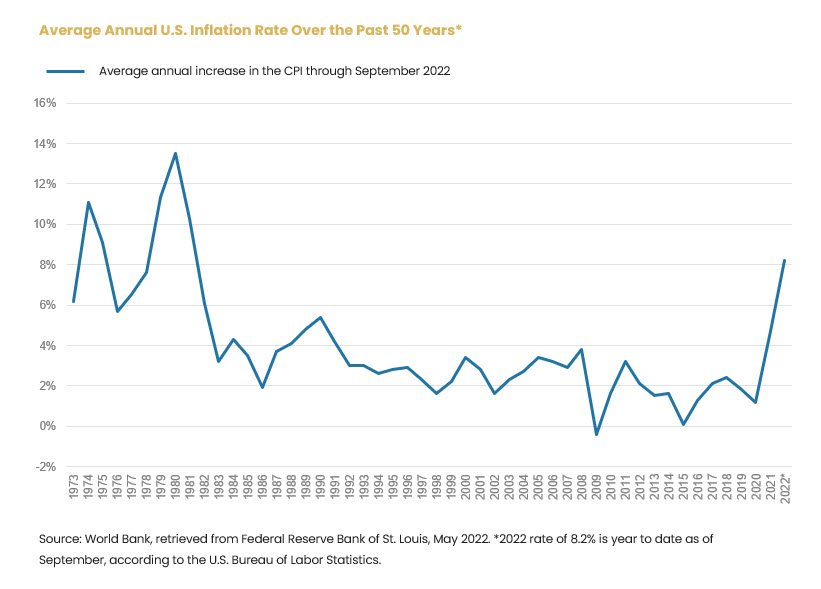

The June year-over-year Consumer Price Index (CPI) was 9.1%. That's the largest annual gain since 1981.

In an effort to cool inflation, the Federal Reserve is expected to continue raising its key interest rate for the foreseeable future. Even so, it may be challenging for the Fed to succeed in the near-term, given the increasing consensus that the risk of continued elevated inflation is real and may be more persistent than initially thought.

So, with higher inflation likely remaining for some time, here are six things every investor should know:

1) Inflation has elevated to levels not seen in decades.

During the 1970s and early 80s, inflation soared to historic levels where average annual price increases hit double digits. It took the Federal Reserve raising its benchmark rate to as high as 20% in the early 1980s to cool things down.1 While today's inflation rate is not quite that high, it is at the highest level we've seen in many years.

2) Some level of inflation is good.

Low levels of inflation encourage consumers to buy now instead of later, which is good for businesses, employment and the economy. In fact, the Federal Reserve targets an approximate 2% inflation rate, where it is believed to support a healthy and stable economy.

All things considered, moderate levels of inflation can be considered better for the economy relative to deflation, or steadily falling prices. Deflation can have a domino effect: Consumers delay spending as they wait for prices to drop further. Companies cut production. Profits slump. Layoffs rise. And the economy suffers.

3) As a measure of inflation, the CPI is widely used but not perfect.

The Consumer Price Index (CPI) is the broadest and most recognized measure of inflation but is not a perfect measure.

"It incorporates things that may be slower moving, like rent and the cost of mortgages, which can underestimate the 'real feel' of inflation for many consumers," says Don Casturo, chief investment officer of Quantix Commodities LP.

"Commodities, which are very highly tied to the more discretionary part of the consumer budget, can be much more effective in hedging real-feel inflation. For example, if the wholesale price of gasoline that we trade increases, it is very quick to feed through to the consumer at the pump."

4) Investors typically rely on a handful of traditional inflation hedges.

To limit the erosion of their purchasing power, investors traditionally have turned to these hedges:

- Commodities because prices tend to climb as inflation accelerates and have historically shown to have the highest correlation to inflation.

- Treasury Inflation Protected Securities (TIPS) and Series I Savings Bonds because payouts are tied to inflation.

- Real estate investment trusts (REITs) that can raise rents on the properties they own.

- Inflation-sensitive stocks - particularly in the energy, healthcare and consumer staples sectors that continue to see consumer demand even as prices rise.

5) Choosing an effective hedging strategy depends on your goals.

Income-producing inflation hedges may work for income-oriented investors aiming to guard the purchasing power of cash generated by either bonds or income-producing equities. However, these asset classes tend to be rate sensitive and can lose value when rates rise.

They may also be less effective for return-oriented investors who want to maintain the distribution of a portfolio without overweighting their equity or fixed-income exposures.

For return-oriented investors, commodity futures have been shown to be a strong portfolio diversifier, while also providing the most reliable protection against inflation over decades (as compared to TIPS, energy stocks and REITs), according to Quantix research.2

6) We believe investing in commodity futures for inflation hedging has been enhanced.

Navigating the world of commodity futures-contracts to buy or sell a commodity at a specific price and time-can be complicated for individual investors. The new Harbor All-Weather Inflation Focus ETF (Ticker symbol HGER) seeks to make that easier for investors by taking a more thoughtful and dynamic approach to commodities-based inflation hedging.

The ETF is purpose-built to help hedge inflation and is managed by Quantix Commodities LP, which specializes in commodities-based investment strategies. HGER seeks to track the Quantix Inflation Index, which is composed of futures contracts for physical commodities, such as oil, grains and precious metals. The goal is to provide investors a powerful tool for hedging against different types of inflation across all market environments.

"Inflation is top of mind for our clients, having recently reached levels not seen in decades in the U.S.," says Kristof Gleich, president and chief investment officer of Harbor Capital Advisors. ·we hope this ETF will help them navigate through these uncertain times."

About HGER

- Targets liquid and inflation-sensitive commodities

- Accounts for multiple forms of inflation

- Addresses the impact of future roll yields

- Avoids K-1 tax filings

- Leverages the potential benefits of an ETF

Check out performance data and fund documents for HGER, our inflation-hedging ETF.

1Memorandum released by The Federal Reserve on August 19, 2019.

2”Why Commodity Futures Provide Better Inflation Protection that other Real Assets for the Return-oriented Investor.” Quantix Commodities, June 2021.

Legal Notices & Disclosures

Quantix Commodities LP (“Quantix”) is a third-party subadviser to the Harbor All-Weather Inflation Focus ETF.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. A non-diversified Fund my invest a greater percentage of its assets in securities of a single issuer, and/or invest in a relatively small number of issuers It is more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio.

Commodity Risk: The Fund has exposure to commodities through its and/or the Subsidiary’s investments in commodity(1) linked derivative instruments. Authorized Participant Concentration/Trading Risk: Only authorized participants (“APs”) may engage in creation or redemption transactions directly with the Fund. Commodity-Linked Derivatives Risk: The Fund’s investments in commodity-linked derivative instruments (either directly or through the Subsidiary) and the tracking of an Index comprised of commodity futures may subject the Fund to significantly greater volatility than investments in traditional securities.

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services.

Unlike mutual funds, the ETFs may trade at a premium or discount to their net asset value. The ETF is new and has limited operating history to judge.

Foreside Fund Services, LLC is the Distributor of the Harbor-All Weather Inflation Focus ETF.

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit our website or call 1-866-313-5549. Read it carefully before investing.

2559512

Locate Your Harbor Consultant

INSTITUTIONAL INVESTORS ONLY: Please enter your zip code to locate an Investment Consultant.