An Opportune Time for "BID"?: Harbor All-Weather Inflation Focus ETF (Ticker HGER)

Executive Summary:

The highly divergent economic drivers of 2020 and 2021 paved the road to higher inflation and tighter monetary policy in 2022. Within this backdrop, we believe investors should consider the near- and long-term benefits of “BID” pertaining to the Harbor All-Weather Inflation Focus ETF (Ticker: HGER) below:

Backwardation:

- Today’s prices for many commodities are higher than what they are priced at in the future.

- We believe HGER is well positioned to take advantage of backwardation and potentially generate added alpha through the strategy’s ability to roll near-term commodities futures contracts to future dated contracts, realizing attractive roll yields.

Inflation Correlation:

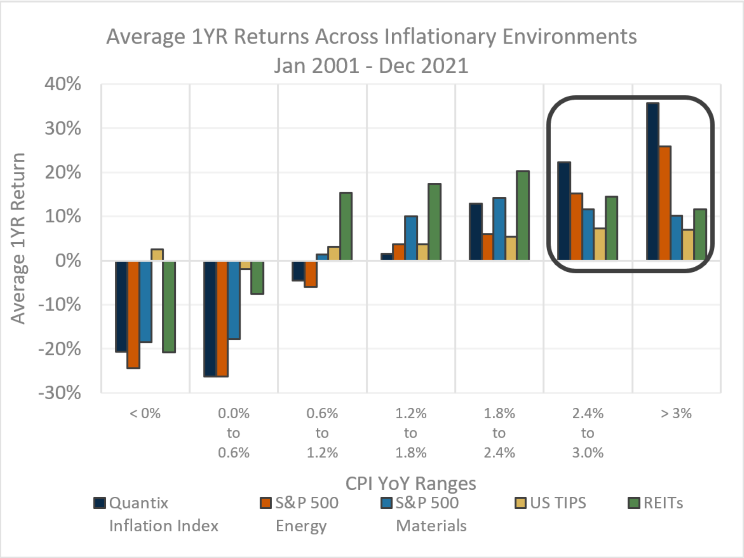

- Commodity futures and HGER’s differentiated approach within the commodities space may represent a compelling option for investors navigating periods of elevated inflation versus assets such as TIPS, REITs, and commodity related equities. *

- The Quantix Inflation Index (QII) tracked by HGER has maintained higher levels of correlation to US CPI and has outperformed, on average, relative to these asset classes during periods of elevated inflation (Exhibits 4 & 5).

Diversification:

- Commodities are a relatively distinct asset class as price movements in the space are mainly driven by the balance of supply and demand.

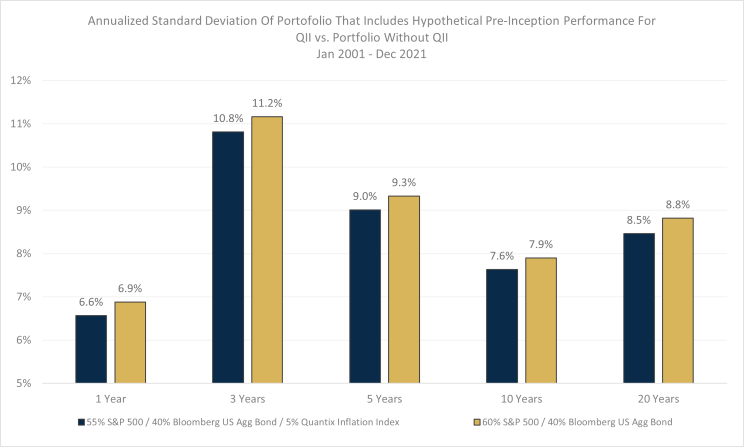

- Adding 5% exposure to the QII within a balanced index portfolio reduced overall volatility, enhanced returns in inflationary periods and minimized the cost of inflation protection over a long-term horizon (Exhibit 7).

* Why Commodities Futures Provide Better Inflation Protection than other Real Assets for the Return-oriented Investor. David Greely, Ph.D., Economist and Investment Strategist, and Senior Advisor, Quantix Commodities.

Introduction:

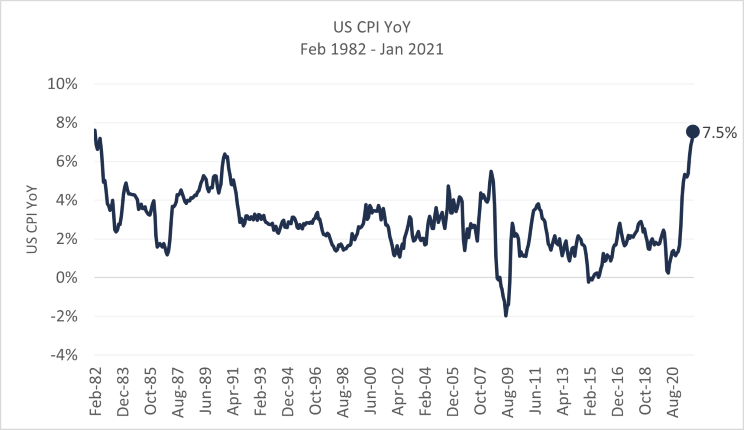

The calendar years of 2020 and 2021 proved to be highly divergent in terms of economic impacts, driving heightened levels of inflation and increased investor uncertainty regarding asset allocation decisions in 2022. The onset of the COVID-19 pandemic in 2020 led to global shutdowns, rapid economic deterioration, and historic fiscal and monetary stimulus responses. Conversely, 2021 marked a year of recovery given positive vaccine developments, deployment, and economic reopening. A resulting release of pent-up demand combined with persistent supply chain disruptions and labor shortages have propelled inflation to levels not seen since the 1980’s as seen in Exhibit 1 below.

Exhibit 1

Source: FactSet Research Systems

Given increased potential for tighter monetary policy, higher interest rates, and decelerating GDP growth, fixed income and risk asset returns have recently exhibited performance weakness. Within a landscape of increased uncertainty, we believe now represents an opportune time for “BID” (Backwardation, Inflation correlation, and Diversification) pertaining to the Harbor All-Weather Inflation Focus ETF (Ticker: HGER).

The sections below walk through the enabled benefits of “BID”, as well as highlight that its components likely provide both nearer- and longer-term advantages for investors. Given this compelling combination of positive catalysts, we believe HGER warrants increased investor consideration in 2022 and beyond.

“B” - Backwardation (Nearer-Term Benefit):

The Harbor All-Weather Inflation Focus ETF (HGER) tracks the Quantix Inflation Index (QII). As part of its methodology, the QII distinctly targets liquid and inflation sensitive commodities, accounts for multiple forms of inflation, and factors in the cost and/or return benefits of holding or rolling futures positions — targeting commodities with relatively higher roll yield return.

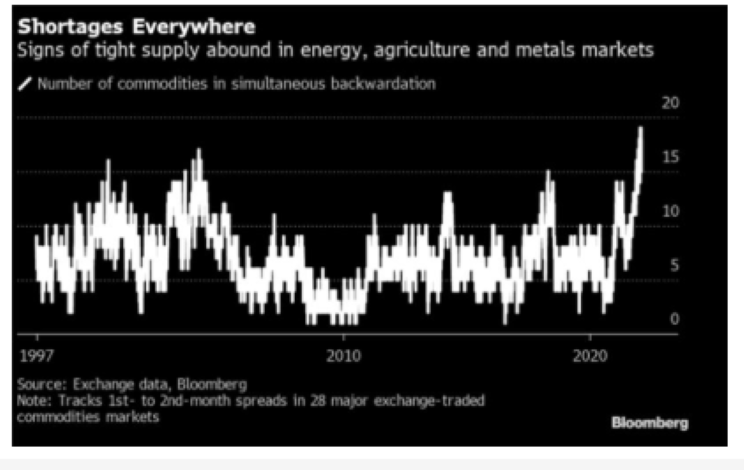

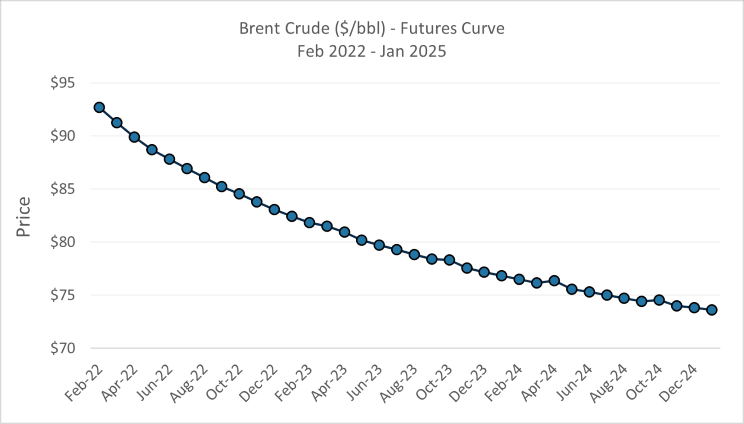

The current environment provides opportunity for potentially enhanced roll yields. Given increased appetite for alternative energy, general multi-year underinvestment by large commodity producers and the sharp uptrend in demand experienced in the post-pandemic era, most commodities are currently in backwardation (Exhibit 3). Said differently, today’s prices for many commodities are higher relative to what they are priced at in the future. Having an effective futures roll strategy in today’s environment may prove to be fruitful for investors.

For instance, Exhibit 3 shows the futures curve for Brent crude oil, which reflects a scarcity premium and differential of $6.61 per barrel between its current price (spot price) and August 2022 contract. With many commodity curves similarly in backwardation, this means that investors are not dependent on rising commodities prices to earn returns in the space.

Importantly, we believe the Harbor All-Weather Inflation Focus ETF is well positioned to generate solid returns through tracking the Quantix Inflation Index (QII) and the potential to capitalize on attractive roll yields.

Exhibit 2

Source: Bloomberg

Exhibit 3

Source: FactSet Research Systems

”I” – Inflation Correlation (Nearer- and Potentially Longer-Term Benefit):

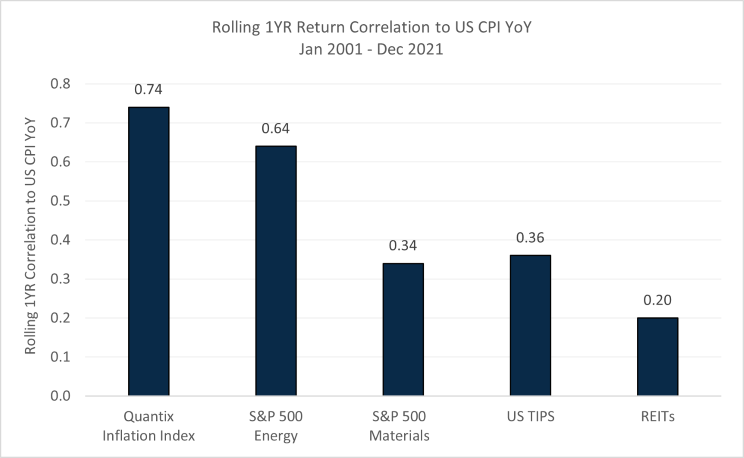

Given ongoing impacts from labor shortages and supply chain disruptions, both Federal Reserve officials and markets are now generally anticipating higher levels of inflation to be more persistent as opposed to transitory in nature. Facing a nearer-term and potentially longer-term backdrop of higher inflation, investors are increasingly seeking the perceived hedging benefits of asset classes such as US Treasury Inflation- Protected Securities (TIPS), Real Estate Investment Trusts (REITs) and commodity related equities.

However, TIPS feature significant interest rate risk and have shown a weak relationship to inflation during periods when real interest rates rise. Also, REITs have historically been pressured by rising interest rates and higher borrowing costs, while commodity related equities have proven susceptible to margin pressure due to rising input costs in inflationary periods.

We believe commodity futures and HGER’s differentiated approach within the space represent a more compelling alternative for navigating periods of elevated inflation. The Quantix Inflation Index (QII) tracked by HGER, targets commodities futures with increased inflation sensitivity via higher pass-through costs and correlations to the US Consumer Price Index (CPI). As such, the Quantix Inflation Index has maintained higher levels of correlation to US CPI and has meaningfully outperformed on average relative to these asset classes during periods of elevated inflation, since its inception in 2001 as seen in Exhibits 4 and 5.

Hypothetical Pre-Inception Index Performance for QII Correlated to US CPI vs Other Asset Class Indexes

Exhibit 4

Source: Bloomberg

The performance data presented with respect to The Quantix Inflation Index (“QII”) (the “Index”) prior to January 14, 2022, represent pre-inception index performance data (“PIP data”) to illustrate how the Index may have performed had it been in existence prior to January 14, 2022. PIP data is based on a criteria applied retroactively with the benefit of hindsight and knowledge of factors that may have positively affected its performance and cannot account for all financial risk that may affect the actual performance of The Harbor All-Weather Inflation Focus ETF (the “ETF”), which seeks to track the Index. The ETF is new February 10, 2022, and any performance prior to the inception of the Index is hypothetical. PIP data may differ from actual performance of the ETP due to Index tracking error and other reasons; and it does not reflect the potential deviation between the market price and the net asset value of ETP shares. While an investor cannot invest directly in the Index, for purposes of showing the PIP data herein, all PIP information represents the Index information net of the 0.68% expense ratio of the ETF. For reference, a full description of the QII’s methodology can be found at the bottom of the Harbor All-Weather Inflation Focus ETF product page here.

Exhibit 6

.png)

Source: Morningstar

“D” – Diversification (Longer-Term Benefit):

Portfolio diversification has historically proven to be an essential part of achieving investment objectives over longer-term horizons given the unpredictability and variability of market conditions. Commodities are a relatively distinct asset class as price movements in the space are mainly driven by the balance of supply and demand and are generally less sensitive to stock and bond market returns. In a diversified portfolio, maintaining exposure to assets such as commodities that move more out of sync with other investments can help reduce overall portfolio volatility and enhance returns over time.

Below, we examine the historical impact of decreasing the equity component of a traditional 60/40 balanced portfolio by 5% and allocating this 5% to the Quantix Inflation Index. As seen below in Exhibit 7, portfolio volatility, as measured by standard deviation, was reduced given the mix shift and allocation to the Quantix Inflation Index over the 1-year, 3-year, 5-year, 10-year, and 20-year annualized time periods.

Exhibit 7

Source: Bloomberg

The performance data presented with respect to The Quantix Inflation Index (“QII”) (the “Index”) prior to January 14, 2022, represent pre-inception index performance data (“PIP data”) to illustrate how the Index may have performed had it been in existence prior to January 14, 2022. PIP data is based on a criteria applied retroactively with the benefit of hindsight and knowledge of factors that may have positively affected its performance and cannot account for all financial risk that may affect the actual performance of The Harbor All-Weather Inflation Focus ETF (the “ETF”), which seeks to track the Index. The ETF is new February 10, 2022, and any performance prior to the inception of the Index is hypothetical. PIP data may differ from actual performance of the ETP due to Index tracking error and other reasons; and it does not reflect the potential deviation between the market price and the net asset value of ETP shares. While an investor cannot invest directly in the Index, for purposes of showing the PIP data herein, all PIP information represents the Index information net of the 0.68% expense ratio of the ETF. For reference, a full description of the QII’s methodology can be found at the bottom of the Harbor All-Weather Inflation Focus ETF product page here.

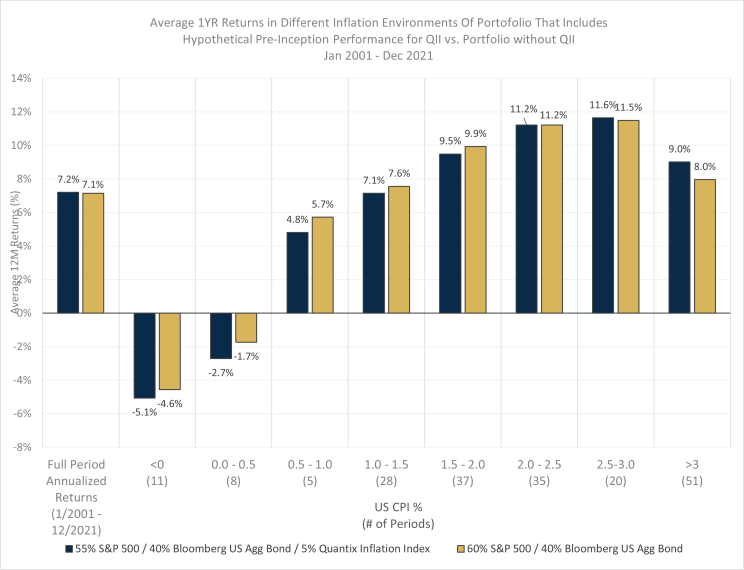

Per Exhibit 8 on the following page, this relatively minor allocation change would have also resulted in an annualized return of 9.0% during periods where US CPI was greater than 3% versus a 60/40 portfolio return of 8.0%.

While the allocation would have proven most detrimental in periods of low CPI, the index’s dynamic commodities allocation factoring in contango versus backwardation minimized the cost of inflation protection throughout the cycle. In fact, the 20-year annualized returns for both portfolios were directionally in-line, slightly favoring the Quantix Inflation Index allocated portfolio.

Exhibit 8

Source: Bloomberg

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Legal Notices & Disclosures

For Institutional Use Only. Not for Distribution to the Public.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

Investors should carefully consider the investment objectives, risks, charges, and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

The Bloomberg US Aggregate Bond Index is an unmanaged index of investment-grade fixed-rate debt issues with maturities of at least one year. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The ETF is new and has limited operating history to judge.

Quantix Commodities LP (“Quantix”) is a third-party subadvisor to the Harbor All-Weather Inflation Focus ETF.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. A non-diversified Fund may invest a greater percentage of its assets in securities of a single issuer, and/or invest in a relatively small number of issuers, it is more susceptible to risks associated with a single economic, political, or regulatory occurrence than a more diversified portfolio.

Commodity Risk: The Fund has exposure to commodities through its and/or the Subsidiary's investments in commodity-linked derivative instruments. Authorized Participant Concentration/Trading Risk: Only authorized participants (“APs”) may engage in creation or redemption transactions directly with the Fund. Commodity- Linked Derivatives Risk: The Fund's investments in commodity-linked derivative instruments (either directly or through the Subsidiary) and the tracking of an Index comprised of commodity futures may subject the Fund to significantly greater volatility than investments in traditional securities.

The Quantix Inflation Index (QII) was developed by Quantix Commodities LP and is owned by Quantix Commodities Indices LLC (“Quantix”). The QII was created with the objective of being a diversified inflation hedge for investors using commodity futures contracts, traded in the U.S. and the U.K., as part of their core investment. Commodity futures are distinctive in their relationship to inflation and are generally regarded as having the highest positive correlation to inflation of all the major asset classes. The QII is designed to provide a risk management framework to hedge inflation risk appropriately in connection with commodity investing, taking account of the relative inflation sensitivity of each commodity among a defined universe of commodities, the relative cost of holding a rolling, U.S. or U.K.-listed futures position in a given commodity and the relative impact of inflation on each particular commodity.

Foreside Fund Services, LLC is the Distributor of the Harbor All-Weather Inflation Focus ETF.

Locate Your Harbor Consultant

INSTITUTIONAL INVESTORS ONLY: Please enter your zip code to locate an Investment Consultant.