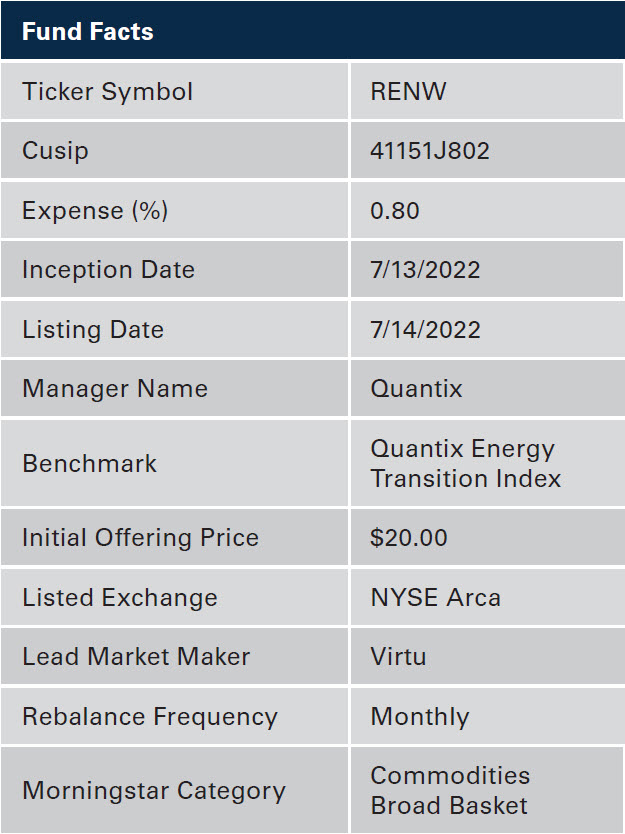

Harbor Energy Transition Strategy ETF (RENW) Quick Hits

Why RENW?

The world is undergoing a dramatic energy regime shift that has only been accelerated by recent events. We believe the transition to cleaner sources of energy may be one of the most significant macro themes in the financial markets for several decades.

RENW is built to provide the opportunity to invest in this transition, through the commodities needed to facilitate change, as the world marches towards a net zero carbon emissions goal.

- A generational transition from fossil fuels to lower carbon sources of energy is evolving and accelerating

- Commodities required to meet the needs of a new societal infrastructure are known and needed to help facilitate the transition to cleaner energy

- Energy transition commodities are expected to be in demand for decades to come

Potential to:

Capture the societal movement to cleaner energy with the commodities expected to help facilitate change

Leverage the only broad commodities-based ETF that targets commodities associated with the accelerating transition to reduced carbon-intensive sources of energy

Access a powerful strategy with no K-1s and all the potential benefits of an ETF – cost effectiveness, liquidity, transparency, and tax efficiency

About

RENW is managed by Quantix Commodities LP (“Quantix”), a market leader in the development and delivery of comprehensive and innovative commodity investment strategies. The fund tracks the Quantix Energy Transition Index (“QET”), created by Quantix. QET was designed with the objective of providing diversified exposure to the building blocks of the accelerating transition from higher to lower carbon intensive sources of energy using commodity futures.

Portfolio Implementation Ideas:

Thematic allocation - potential to express conviction in energy transition with commodities

Growth allocation - ability to potentially capitalize on the expected high demand for energy transition commodities

Diversification Potential – access broad-commodities which may enhance overall portfolio diversification

About the Manager

Quantix Commodities LP ("Quantix") is a commodities focused fund manager specializing in the development and management of commodities-based investment strategies. The firm is a market leader in delivering comprehensive and innovative commodity investment solutions to the marketplace.

The Quantix Team

Quantix is a seasoned investment team averaging 20+ years of experience investing in commodities.

The team worked side-by-side for 7 years at Goldman Sachs to run one of the largest commodity index portfolios, pioneered innovative trading techniques to outperform commodity indices, and developed bespoke investor solutions.

Team members each led major business lines within commodities at Goldman Sachs, a mark of their fundamental expertise, across all sectors of the commodity markets.

Important Information

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The ETF is new and has limited operating history to judge. Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

Commodity and Commodity Linked Derivative Risk: The Fund has exposure to commodities through its and/or the Subsidiary’s investments in commodity-linked derivative instruments. The Fund’s investments in commodity-linked derivative instruments (either directly or through the Subsidiary) and the tracking of an Index comprised of commodity futures may subject the Fund to significantly greater volatility than investments in traditional securities. The Fund is non-diversified and may invest a greater concentrate of its assets in a particular sector of the commodities market (such as metal, gas or emissions products). As a result, the Fund may be more susceptible to risks associated with those sectors. Authorized Participant Concentration/Trading Risk: Only authorized participants (“APs”) may engage in creation or redemption transactions directly with the Fund. Energy Transition Risk: The commodities included in the Index may become less representative of energy transition trends over time and the Fund’s investments may be significantly impacted by government and corporate policies. Foreign Currency Risk: Because the Index may include futures contracts denominated in foreign currencies, the Fund could be subject to currency risk

The Quantix Energy Transition Index (QET) was developed by Quantix with the objective of providing diversified exposure to the building blocks of the accelerating transition from carbon-intensive energy sources to less carbon intensive sources of energy using commodity futures. Commodity futures that provide exposure to the energy transition theme are considered component candidates for inclusion in the Index. Examples of component commodity candidates include copper, aluminum, nickel, zinc, lead, natural gas, silver, palladium, platinum, soybean oil, ethanol, emissions – European Union Allowances (EUA), and emissions – California Carbon Allowances (CCA). The selection of commodities is subject to periodic review by Quantix Commodities Indices (QCI). Under normal conditions, the Index maintains exposure to at least 10 commodities from its eligible universe in the United States (U.S.), Canada, United Kingdom (U.K.) and other European exchanges. Commodity futures from the component candidates are selected for the Index and weighted based on QCI’s quantitative methodology. Under normal circumstances, the Index is rebalanced on a monthly basis. The index listed is unmanaged and does not reflect fees and expenses and is not available for direct investment.

ETFs are subject to capital gains tax and taxation of dividend income. However, ETFs are structured in such a manner that taxes are generally minimized for the holder of the ETF. An ETF manager accommodates investment inflows and outflows by creating or redeeming “creation units,” which are baskets of assets. As a result, the investor usually is not exposed to capital gains on any individual security in the underlying portfolio. However, capital gains tax may be incurred by the investor after the ETF is sold.

Schedule K-1 is an Internal Revenue Service (IRS) tax form issued annually for an investment in a partnership. A Schedule K-1 is issued to taxpayers who have invested in limited partnerships (LPs) and some exchange-traded funds (ETFs).

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

Quantix Commodities LP (“Quantix”) is a third-party subadviser to the Harbor Energy Transition Strategy ETF.

2389360

Locate Your Harbor Consultant

INSTITUTIONAL INVESTORS ONLY: Please enter your zip code to locate an Investment Consultant.