Asset Allocation Viewpoints & Positioning - February 2022

Fog of War, Not Fog of Earnings

While the situation unfolding in Ukraine is tragic, we see limited downside to S&P 500 EPS estimates based on the conflict

Updated Perspectives

- Outcomes from war are notoriously difficult to forecast. We therefore look to ground ourselves in our Multi-Asset Solutions Team’s three asset allocation pillars: growth momentum, valuations/expected returns, and the liquidity cycle. How does the Russia/Ukraine war impact our pillars?

- Growth momentum: Ceteris paribus, acutely higher commodity prices may slow real consumption. However, the war in Ukraine is not happening in a vacuum; it is happening at a time of reaccelerating growth momentum as Omicron wanes and the developed world re-opens.

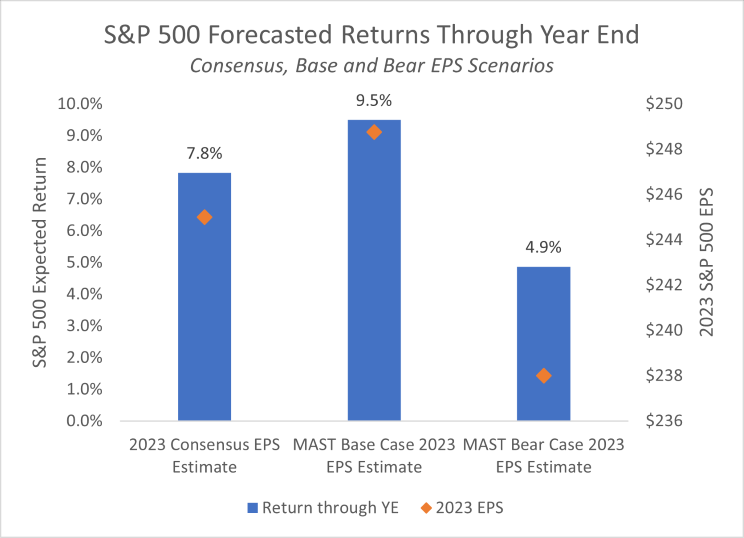

- Valuations/expected returns: We adjust our estimates for the fair value of the S&P 500 PE multiple down based on higher real rates and a lower PMI by the end of the year. Based on this, our base case scenario calls for high single digit returns from here through year-end. Using our bear-case scenario EPS estimate, where real consumption slows more than we currently expect, we still see mid-single digit upside.

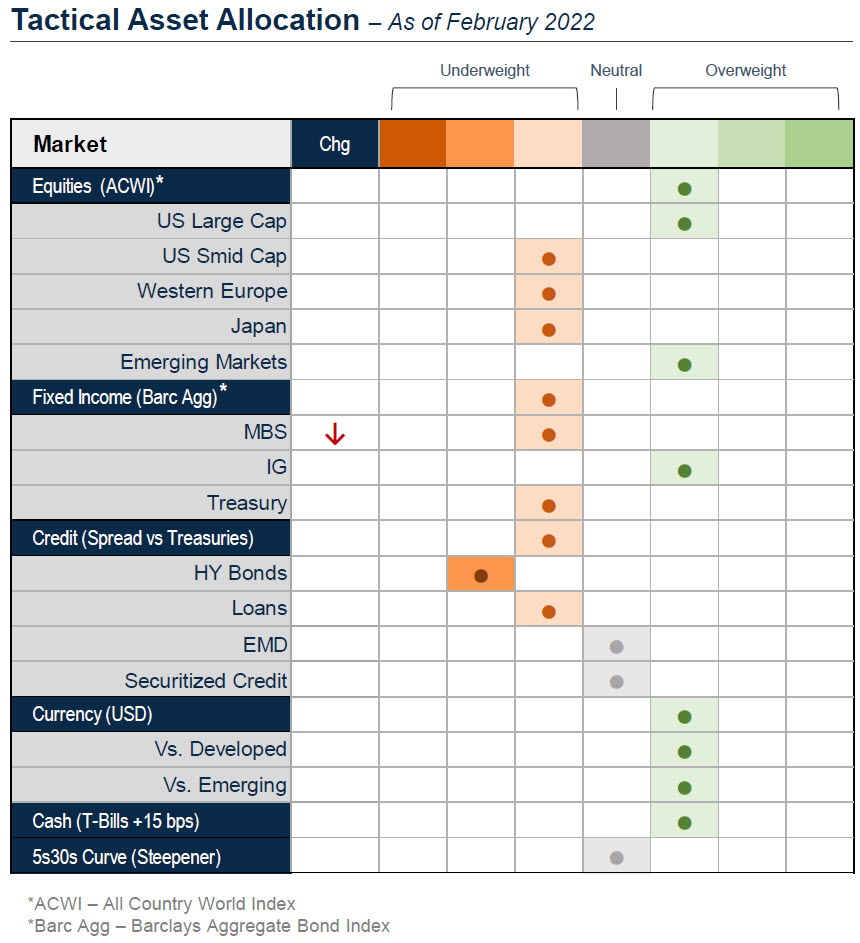

- Liquidity cycle: Not much changes in the short term; we will likely get ~six 25bp hikes in 2022 along with Quantitative Tightening, and then it could depend where core inflation ends the year. We downgrade MBS as the largest buyer will soon become a seller and spreads will likely suffer.

Source: MAST, February 2022

Legal Notices & Disclosures

The views expressed herein are those of the Harbor Multi Asset Solutions Team at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. These views are not necessarily those of the Harbor

Investment Team and should

not be construed as such. The information provided is for informational purposes only.

Past performance is no guarantee of future

results.

Forecast returns are based on hypothetical assumptions. It is for informational and illustrative purposes only. This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy. The forecasted returns presented do not represent the results that any particular investor may actually attain. Actual performance results will differ, and may differ substantially, from the hypothetical estimated performance. Indices do not reflect fees and expenses and are not available for direct investment.

All investments are subject to market risk, including the possible loss of principal. Stock prices can fall because of weakness in the broad market, a particular industry, or specific holdings. Bonds may decline in response to rising interest rates, a credit rating downgrade or failure of the issue to make timely payments of interest or principal. International investments can be riskier than U.S. investments due to the adverse affects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets.

Fixed income securities fluctuate in price in response to various factors, including changes in interest rates, changes in market conditions and issuer-specific events, and the value of an investment may go down. This means potential to lose money.

As interest rates rise, the values of fixed income securities are likely to decrease and reduce the value of a portfolio. Securities with longer durations tend to be more sensitive to changes in interest rates and are usually more volatile than securities with shorter durations. Interest rates in the U.S. are near historic lows, which may increase exposure to risks associated with rising rates. Additionally, rising interest rates may lead to increased redemptions, increased volatility and decreased liquidity in the fixed income markets.

2706783

Locate Your Harbor Consultant

INSTITUTIONAL INVESTORS ONLY: Please enter your zip code to locate an Investment Consultant.