Asset Allocation Viewpoints & Positioning Q3 2020

Actionable investment conclusions from Harbor’s Multi-Asset Solutions Team

Key Takeaways

- Growth is still good, although we expect the pace of growth to slow in the months ahead

- We think the recent pull-back is more likely to be short term in nature rather than signaling something worse

- We think inflation has probably bottomed, although the disinflationary impulse is strong; therefore, we expect rates to remain low

- Core asset class returns still look good over the next 12 months, despite many risks between now and then

- There are more exogenous and unquantifiable risks surrounding the U.S. right now vs. non-U.S.

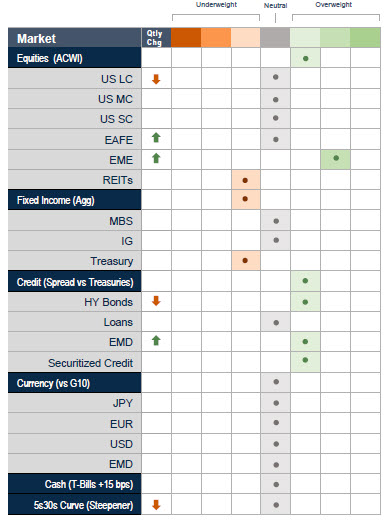

Tactical Asset Allocation & Market Themes

All charts and tables are shown for illustrative purposes only. | Fixed Income •As the economic expansion continues to evolve into a self-sustaining recovery no longer dependent solely on fiscal and monetary stimulus, we believe high quality fixed income will likely generate unattractive returns as compared to credit and equities. In fact, we believe it is probable that real yields on the Bloomberg Barclays Aggregate (Agg) remain negative for some time. •Normally, the current growth environment would suggest yields should rise and adjust for higher future growth and the potential for inflation. The Multi-Asset Solutions Team (MAST) believes, however, that continued quantitative easing coupled with elevated exogenous and ‘difficult-to-quantify’ risks will keep a bid for these assets and prevent yields from rising. Equity Markets •The expansion continues to unfold and broaden with MAST forecasting attractive expected returns for equities over the next 12-18 months. The many exogenous risks looming over markets, however, temper the team’s enthusiasm; the modest overweight in equities therefore remains unchanged. •The U.S. has outsized exposure to numerous downside risks while Emerging Markets (EM) and EAFE have much less exposure to these risks. As the global recovery broadens in scope and gains momentum above and beyond that provided by stimulus, our exposure to equities will become more cyclical and globally diversified. •Specifically, Asia EM has shown tremendous success containing COVID, and most of the EM complex has very little exposure to the outcome of the U.S. election in terms of domestic regulatory and tax policy. As a result, the team is increasing the overweight in EM equities and bringing EAFE to a neutral weight, both being funded by U.S. Large Cap which the team is lowering to a neutral weight. Credit Markets •Although credit fundamentals should continue to improve amidst a self-sustaining economic expansion, the impending default cycle that may reach as much as ~15% of the U.S. High Yield market over the next two years will eat into the potential returns of the asset class. •Driven by an improving economic backdrop and liquidity support from the Fed, credit spreads tightened over the third quarter with U.S. High Yield spreads now sitting near long-term averages. MAST is reducing their U.S. High Yield position to a modest overweight due to a less attractive risk return profile and is shifting into Emerging Market Debt (EMD). EMD offers a comparable yield with less default risk while further diversifying outside of the U.S. |

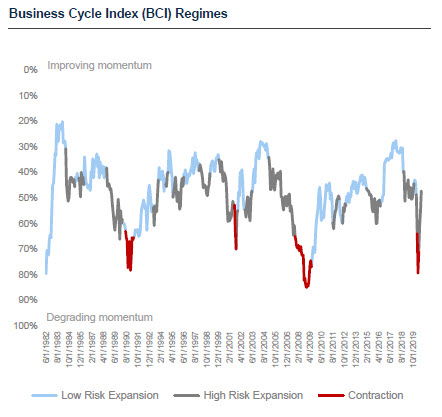

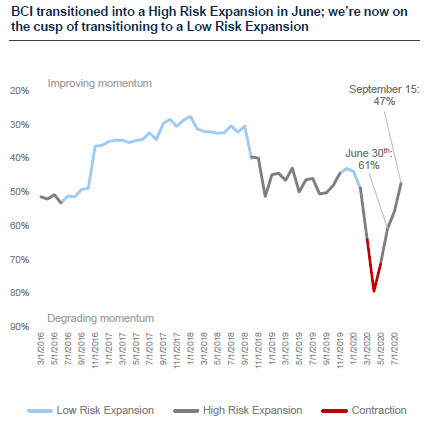

Still High Risk Expansion; On the Verge of Entering a Low Risk Expansion

Source: Harbor MAST, Conference Board, September 2020 |  |

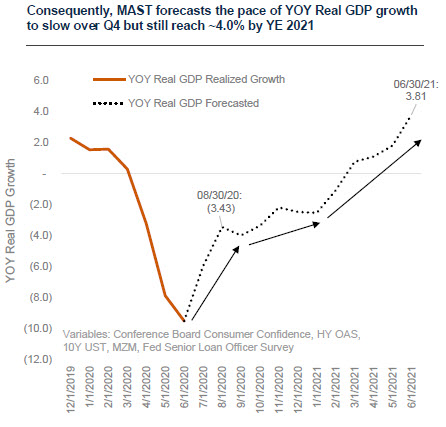

Growth Should Likely Still Improve through 2021

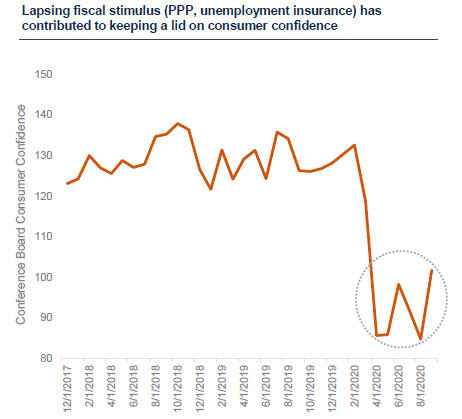

We Believe the Pace of Growth Acceleration Will Slow in Q4 Due Partly to Lapsing Fiscal Stimulus; We See this as Transitory

Source: Harbor MAST BCI and Rate of Change Index, September 2020; See Legal Notices and & Disclosures on page 9 for full list of BCI Index constituents |  |

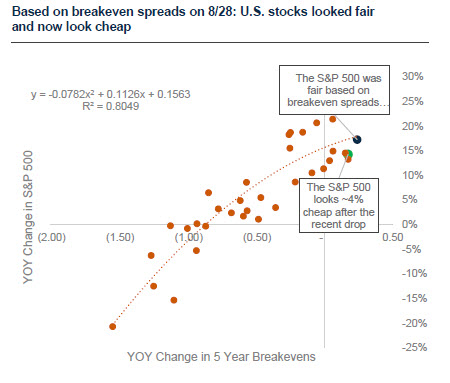

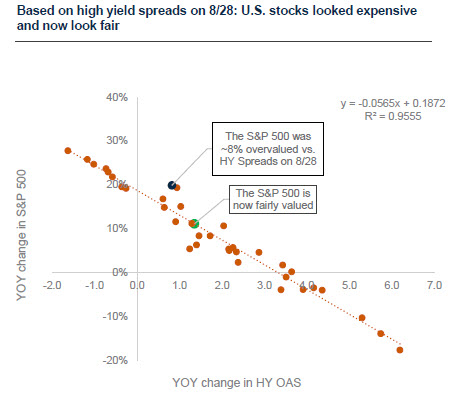

MAST Tactical Equity Models Indicate Recent Volatility will be Short-lived

Source: Harbor MAST, Bloomberg, September 2020 |  |

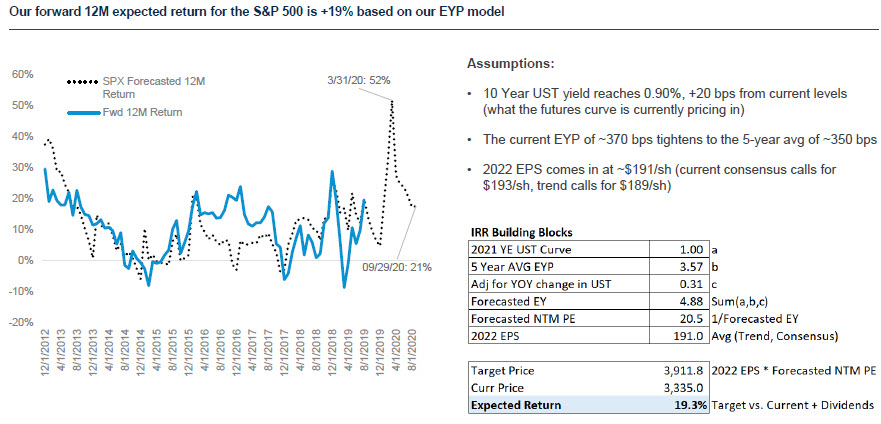

Model Shows Significant Upside through YE 2021

Source: Harbor MAST, Bloomberg, September 2020

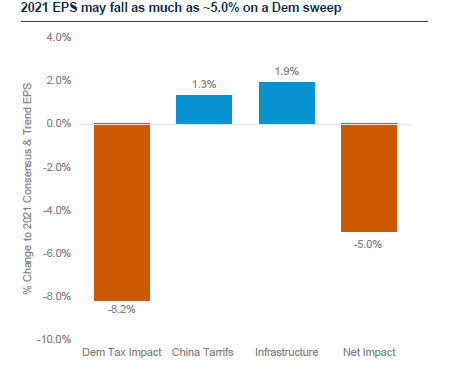

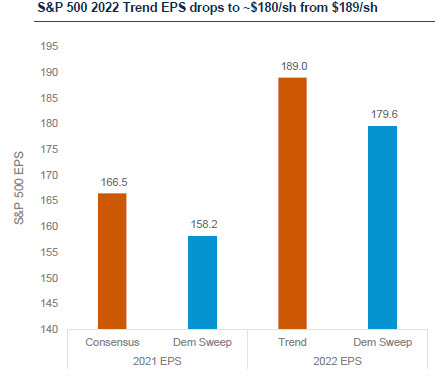

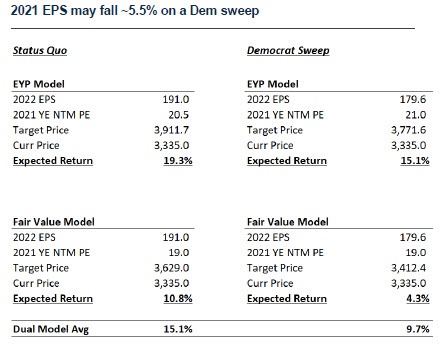

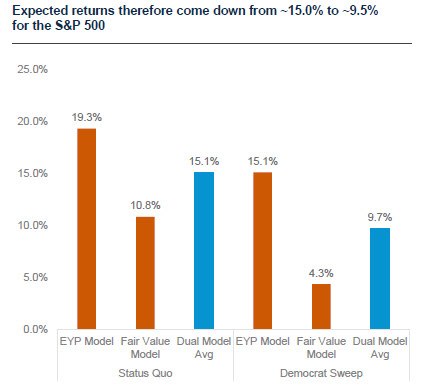

A Democrat Sweep May Lower 2021/2022 EPS By 5.0%

Higher Corporate Tax Rate is Most Alarming to Long Term Valuations

Source: Harbor MAST, JoeBiden.com, Bloomberg, September 2020 |  |

Reducing EPS in 2022 Lowers Return Assumptions For U.S. Equities

|  |

What Keeps Us Up at Night…

- Resurgence of COVID-19 and shutdowns – Unfavorable for U.S. and Europe

We are now seeing a resurgence of COVID cases in Western Europe, with particularly alarming numbers in France, Spain and England. We are also beginning to see a slight tick-up in the U.S., likely from many students going back to school. If these rising cases remain in the relatively younger population and thus result in a low mortality rate and manageable level of hospitalizations, then we will not likely experience further lockdowns. However, if this is not the case, the possibility of lockdowns rises. Even without lockdowns, consumer behavior may adjust and weaken economic activity on the margin. - Vaccine Risk – Unfavorable for U.S. and Europe

This revolves around the timing and efficacy of any commercialized vaccine(s). After recent testimony from Fauci and Redfield, as well as commentary from several large pharma companies, it is now widely anticipated that we may have an approved vaccine by the end of the year, and more broadly available by the middle of 2021. If this does not prove to be the case, or if too many people refuse to get the vaccine, we may be living with below-potential growth for an extended period. - Policy mistakes – Unfavorable for U.S.

Successful monetary and fiscal policies have been key to the recovery in risk asset prices since March and correspondingly the faster-than anticipated recovery in the economy thus far. Although it’s unlikely the Fed will raise interest rates prematurely, removing QE too soon is a potential risk. Further, the lapsing of fiscal stimulus is already impacting growth and it’s not certain if there will be more fiscal stimulus next year. This may lead to increasing defaults and lower consumption. - Geo-political risks with China – Unfavorable for China

Tariffs in 2018 nearly pushed the U.S. and global economy into a contraction as private fixed investment dried up and corporate profits briefly turned negative on a year-over-year basis. The consensus in Washington is to increase the level of confrontation with China which may be harmful for corporate profits and economic growth. This will likely be worse if Trump is reelected, but the risks do not vanish with a Biden administration, they simply lessen. - Election risk – Unfavorable for U.S.

Biden proposals include increasing the corporate tax rate from 21% to 28%, alternative minimum tax on net income for multinationals, negotiate and restrain drug prices in Medicare and Medicaid, restrict launch prices, etc. - Regulatory risk with Big Tech – Unfavorable for U.S.

The Justice Department has ramped up its Google probe; given the size of Big Tech and their concentration in passive indices, this could have a significant impact on markets. The risk is greater here with a Biden election victory.

Legal Notices & Disclosures

Past performance is no guarantee of future results

All charts and tables are shown for illustrative purposes only.

The information shown relates to the past. Past performance is not a guide to the future. The value of an investment can go down as well as up. Investing involves risks including loss of principal.

All investments are subject to market risk, including the possible loss of principal. Stock prices can fall because of weakness in the broad market, a particular industry, or specific holdings. Bonds may decline in response to rising interest rates, a credit rating downgrade or failure of the issue to make timely payments of interest or principal. International investments can be riskier than U.S. investments due to the adverse affects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets.

The views expressed herein are those of the Harbor Multi-Asset Solutions Team at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. These views are not necessarily those of the Harbor Investment Team and should not be construed as such. The information provided is for informational purposes only.

Fixed income securities fluctuate in price in response to various factors, including changes in interest rates, changes in market conditions and issuer-specific events, and the value of an investment may go down. This means potential to lose money.

As interest rates rise, the values of fixed income securities are likely to decrease and reduce the value of a portfolio. Securities with longer durations tend to be more sensitive to changes in interest rates and are usually more volatile than securities with shorter durations. Interest rates in the U.S. are near historic lows, which may increase exposure to risks associated with rising rates. Additionally, rising interest rates may lead to increased redemptions, increased volatility and decreased liquidity in the fixed income markets.

Harbor MAST BCI Index Sources: Harbor MAST, Bloomberg, Institute of Supply Management, Federal Reserve, Bureau of Labor Statistics, Commodity Research Bureau, National Federation of Independent Business (NFIB), Caixin, European Commission, Japan Machine Tool Builder’s Association, Association of American Railroads, American Iron and Steel Institute, Department of Labor, Conference Board, University of Michigan, Redbook Research, National Association of Homebuilders, Mortgage Bankers Association.

Harbor MAST BCI and Rate of Change Index Sources: Harbor MAST, Bloomberg, Institute of Supply Management, Federal Reserve, Bureau of Labor Statistics, Commodity Research Bureau, National Federation of Independent Business (NFIB), Caixin, European Commission, Japan Machine Tool Builder’s Association, Association of American Railroads, American Iron and Steel Institute, Department of Labor, Conference Board, University of Michigan, Redbook Research, National Association of Homebuilders, Mortgage Bankers Association.

2706783

Locate Your Harbor Consultant

INSTITUTIONAL INVESTORS ONLY: Please enter your zip code to locate an Investment Consultant.