Asset Allocation Viewpoints & Positioning Q4 2020

Asset Allocation Viewpoints & Positioning

Fourth Quarter 2020

Actionable investment conclusions from Harbor’s Multi-Asset Solutions Team

Read the updated perspectives here

Macro Landscape

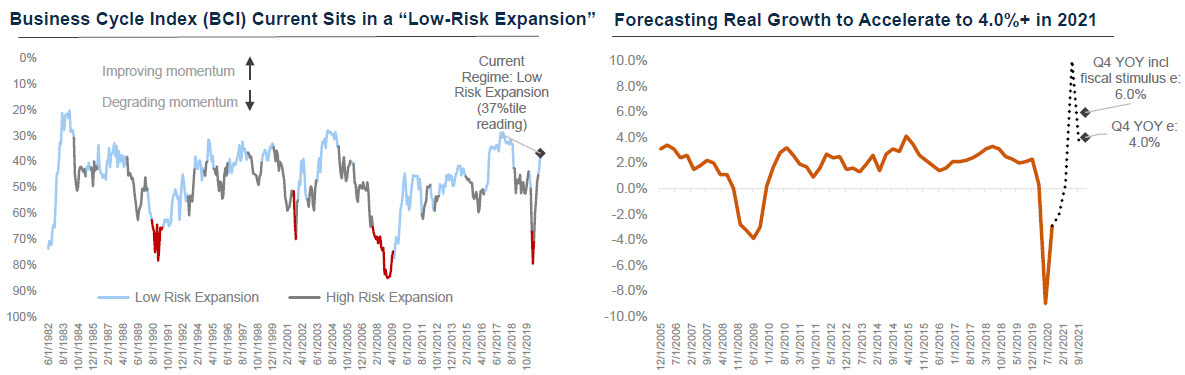

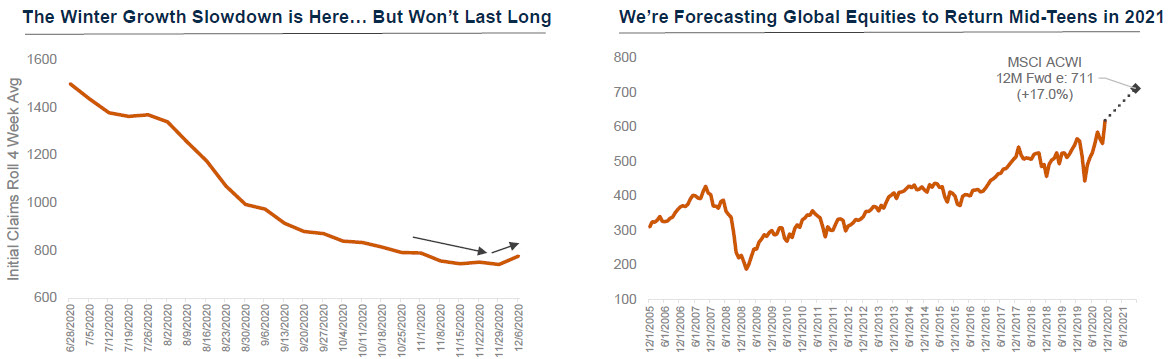

The winds of winter and a dream of spring: the winter growth slowdown is here, but we’re looking over the horizon to the “growth boom of 2021”

- Growth is set to slow in the short term for the developed world on the back of lockdowns in the U.S. and Europe, but we believe this will be short lived; we are positioning for a strong reacceleration of growth momentum beginning early in 2021.

- We are forecasting above trend growth in the U.S. and strong growth in China for 2021; together both countries make up 50% of marginal global growth.

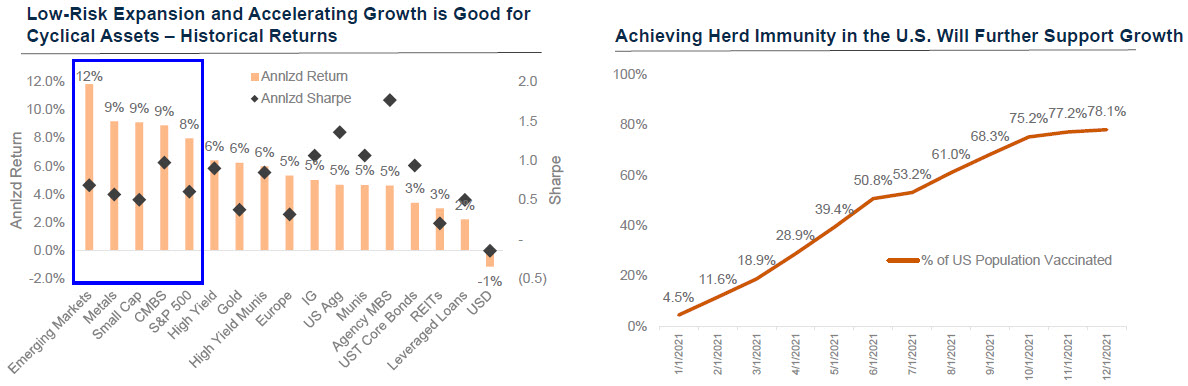

- Numerous risks that were still outstanding in Q320 have been favorably resolved - or at least put behind us; chief among them the effectiveness and deployment of vaccinations in the U.S. and abroad, in addition to the U.S. elections; we anticipate that most of the U.S. population will be vaccinated by the 2ndhalf of 2021.

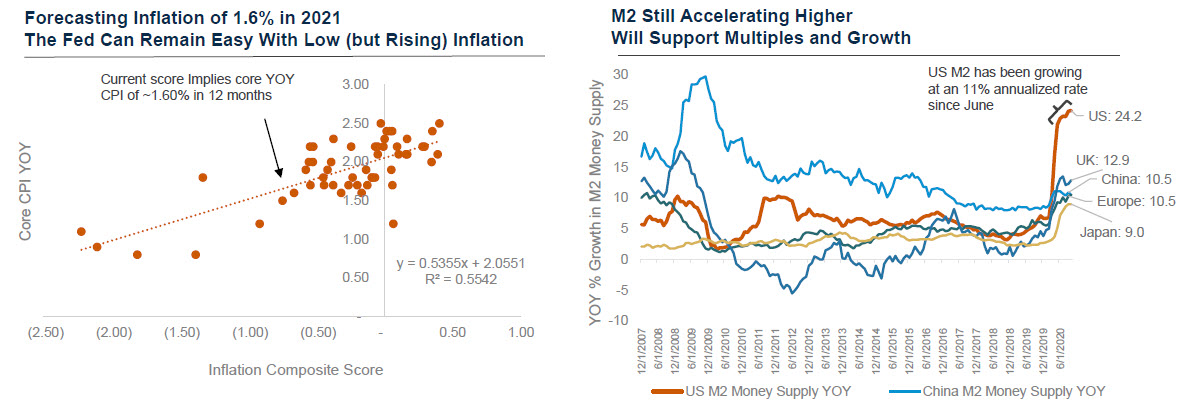

- We see more tailwinds than headwinds for next year: 1) high probability of achieving heard immunity in the 2nd half of 2021, 2) fiscal stimulus in the U.S. that may boost growth as much as two percentage points above our base case, 3) highly accommodative Fed, 4) high levels of pent-up demand for cyclical services such as travel and hospitality

- Key risks we’re watching: 1) Georgia runoff elections, 2) vaccine timeline and adoption, 3) winter double dip instead of a winter slowdown, 4) inflation, and 5) Fed policy mistake

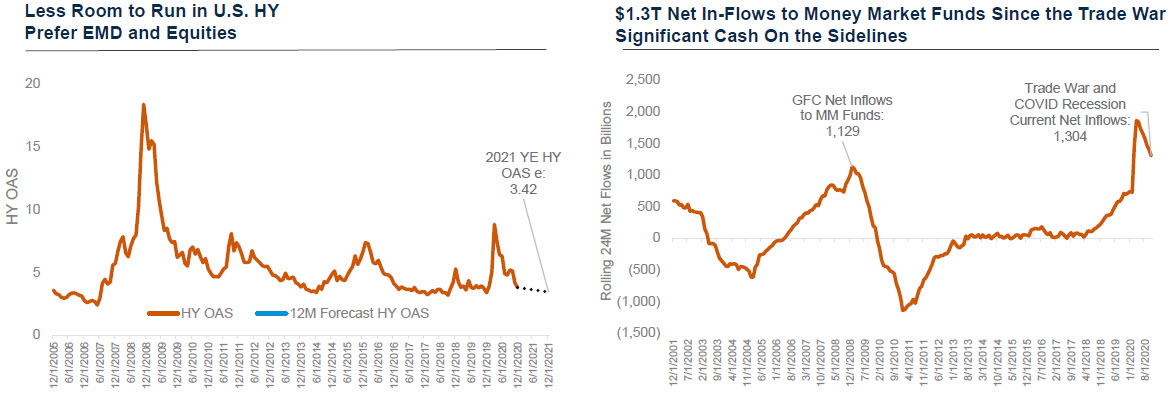

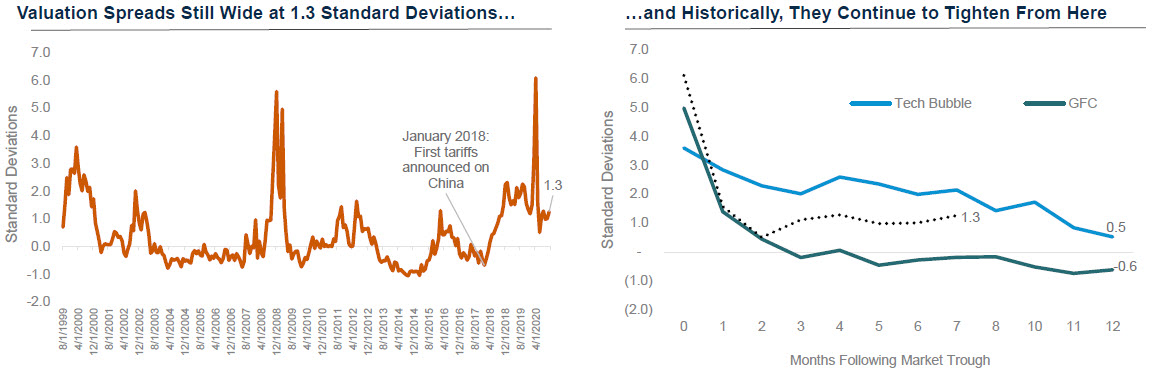

- We think equities are the most attractive asset class going into 2021 with total return potential in the mid teens globally; we prefer cyclical regions and styles to defensives and non cyclicals (secular growth)

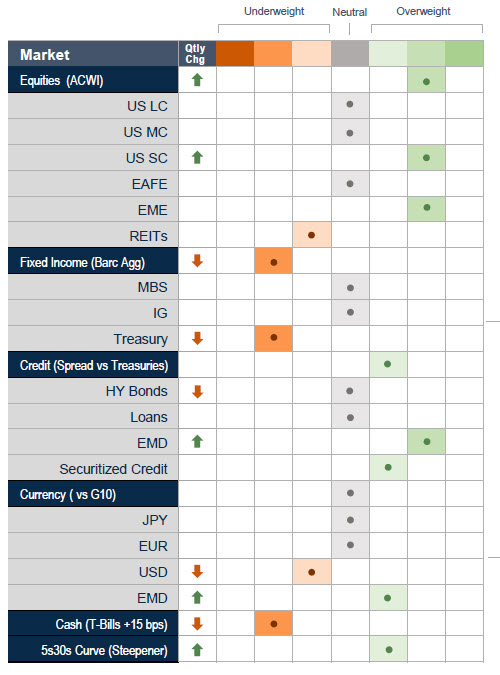

Tactical Asset Allocation & Market Themes

| Equity Markets

Fixed Income

Credit Markets

|

Top Twelve Takeaways

Sources: Harbor MAST U.S. and China BCIs (Top Left), Harbor MAST U.S. Fundamental Real GDP Forecast; Bloomberg; Federal Reserve; Association of American Railroads (Top Right), Harbor MAST BCI Index; Harbor MAST Real GDP Growth Forecast (Bottom Left), UBS Biopharma Analysis (Bottom Right), as of December 2020. See Legal Notices & Disclosures.

Sources: Harbor MAST; Federal Reserve; Bureau of Economic Analysis; Bureau of Labor Statistics; Congressional Budget Office; Bloomberg (Top Left), Harbor MAST BCI and Real YOY GDP Forecast as of September 2020 (Top Right), Harbor MAST; Department of Labor (Bottom Left), Harbor MAST; Bloomberg (Bottom Right), as of December 2020. See Legal Notices & Disclosures.

Sources: Bloomberg, Institute of Supply Management (Top Left), Harbor MAST; Morningstar (Top Right), Harbor MAST; Barra, FactSet (Bottom Left and Bottom Right), as of December 2020. See Legal Notices & Disclosures.

What Keeps Us Up at Night…

- Winter Double Dip Instead of a Winter Growth Slowdown

Growth appears to be decelerating in both Europe and the U.S. as a result of lockdowns in response to elevated COVID-19 cases. While we believe this will be short lived and the economies of both regions will continue to expand despite the lockdowns, the risk of a double dip recession is not zero. We will continue to monitor very closely the economic backdrop in both regions. - Georgia Runoff Elections

Online betting markets currently place the odds at ~66% for at least one seat in Georgia to be won by a Republican. If, however, both seats end up being won by a Democrat, then the Senate will start its new session with 50 Democrats and 50 Republicans. In this scenario, Vice President elect Kamala Harris would act as the tie breaker and create an effective Democrat sweep of both Congress and the White House. If that were to occur, we would likely see a larger fiscal stimulus next year but also more sweeping regulatory reforms and higher corporate taxes. We will be watching this election outcome very closely. - Vaccine Adoption and Success

It currently looks like enough vaccines will be approved and available early next year with sufficient manufacturing and distribution capacity to vaccinate most of the U.S. and much of the developed world. There is a risk, however, that enough of the population chooses to not get vaccinated and therefore prevent herd immunity from being achieved in 2021. - Inflation and Rising Rates

With strong above trend growth next year already in the works and the potential for another massive fiscal stimulus, it is possible that inflation rises faster than the market currently expects and brings with it nominal rates to much higher levels. If inflation reaches ~2.0% next year and nominal rates exceed ~2.0-2.5%, it could downwardly pressure equity multiples and cause the Fed to consider pulling back on stimulus sooner than it otherwise would have. - Fed Mistake

If the Fed chooses to pull back on stimulus too quickly - or send a signal that it’s stimulus and inflationary posture may last shorter than the market expects - it could lead to volatility in rates markets that may then spill over into other asset classes. - Regulatory Risk with Big Tech

The Justice Department has ramped up its Google probe; given the size of Big Tech and their concentration in passive indices, this could have a significant impact on markets. The risk is greater here with a Biden election victory.

Legal Notices & Disclosures

The views expressed herein are those of the Harbor Multi Asset Solutions Team at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. These views are not necessarily those of the Harbor Investment Team and should not be construed as such. The information provided is for informational purposes only.

Past performance is no guarantee of future results.

The information shown relates to the past. Past performance is not a guide to the future. The value of an investment can go down as well as up. Investing involves risks including loss of principal.

All investments are subject to market risk, including the possible loss of principal. Stock prices can fall because of weakness in the broad market, a particular industry, or specific holdings. Bonds may decline in response to rising interest rates, a credit rating downgrade or failure of the issue to make timely payments of interest or principal. International investments can be riskier than U.S. investments due to the adverse affects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets.

Fixed income securities fluctuate in price in response to various factors, including changes in interest rates, changes in market conditions and issuer-specific events, and the value of an investment may go down. This means potential to lose money.

As interest rates rise, the values of fixed income securities are likely to decrease and reduce the value of a portfolio. Securities with longer durations tend to be more sensitive to changes in interest rates and are usually more volatile than securities with shorter durations. Interest rates in the U.S. are near historic lows, which may increase exposure to risks associated with rising rates. Additionally, rising interest rates may lead to increased redemptions, increased volatility and decreased liquidity in the fixed income markets.

Harbor MAST BCI Index Sources: Harbor MAST, Bloomberg, Institute of Supply Management, Federal Reserve, Bureau of Labor Statistics, Commodity Research Bureau, National Federation of Independent Business (NFIB), Caixin, European Commission, Japan Machine Tool Builder’s Association, Association of American Railroads, American Iron and Steel Institute, Department of Labor, Conference Board, University of Michigan, Redbook Research, National Association of Homebuilders, Mortgage Bankers Association

Harbor MAST BCI and Rate of Change Index Sources: Harbor MAST, Bloomberg, Institute of Supply Management, Federal Reserve, Bureau of Labor Statistics, Commodity Research Bureau, National Federation of Independent Business (NFIB), Caixin, European Commission, Japan Machine Tool Builder’s Association, Association of American Railroads, American Iron and Steel Institute, Department of Labor, Conference Board, University of Michigan, Redbook Research, National Association of Homebuilders, Mortgage Bankers Association

© 2021 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

2706783

Locate Your Harbor Consultant

INSTITUTIONAL INVESTORS ONLY: Please enter your zip code to locate an Investment Consultant.