Asset Allocation Viewpoints & Positioning - August 2022

Houston, We Have a Problem…

What's good for headline in not necessarily good for core

Updated Perspectives

- Narratives change quickly, which is why we look to fade narratives and focus on the cycle: the business cycle, the liquidity cycle, the profit cycle, and the sentiment cycle.

- Gasoline prices falling 40% from peak is widely viewed as good for risk. Indeed, it is in some ways – downward pressure on headline inflation and boost to consumption – but let’s not forget that “good is bad” when it comes to the liquidity cycle. More specifically, the boost to real consumption from falling gasoline prices is likely to drive core inflation higher.

- We remain underweight risk broadly and recently reduced risk further as market participants are determined not to miss the “Fed Pivot” … all the while missing the red flashing lights of the cycle instead.

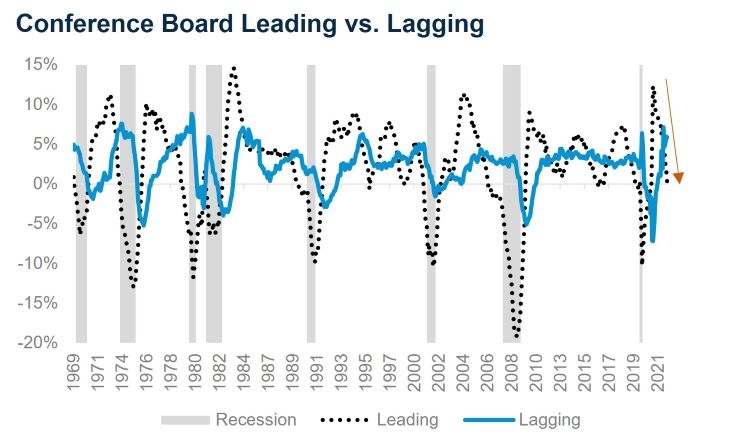

- Coincident and lagging indicators remain reasonably strong; employment trends are robust and retail sales look good, to name a few. Though investing based on coincident and lagging indicators is a bit like driving while looking through the rear-view mirror. We prefer to look ahead, and leading indicators are not painting a rosy picture.

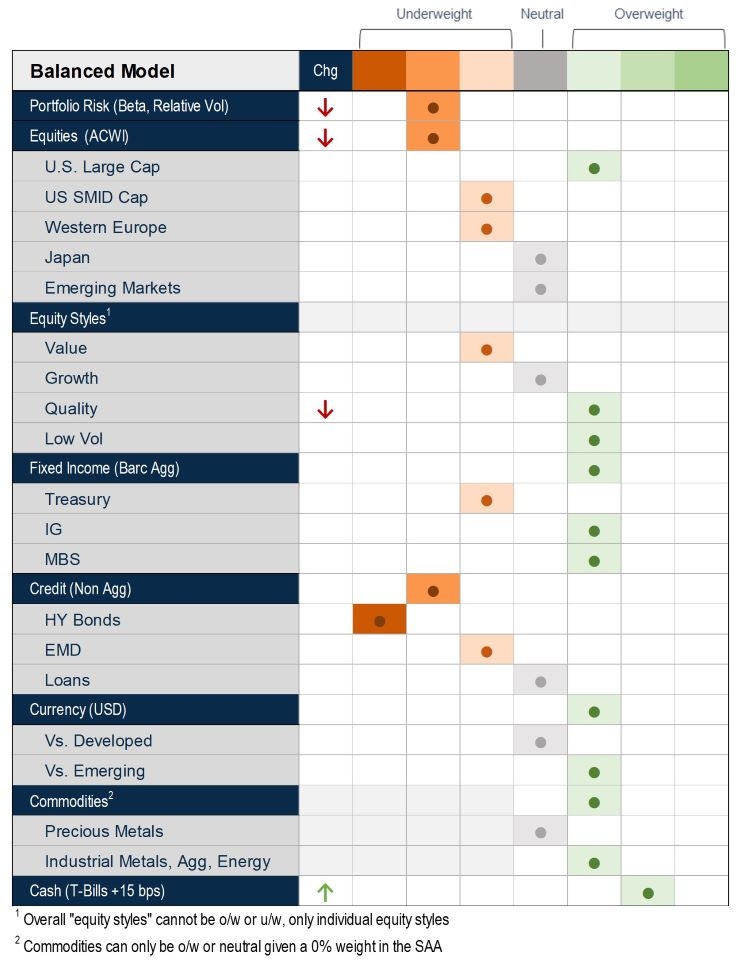

Tactical Asset Allocation – As of August 31, 2022

Source: MAST, August 2022

Updated Perspectives

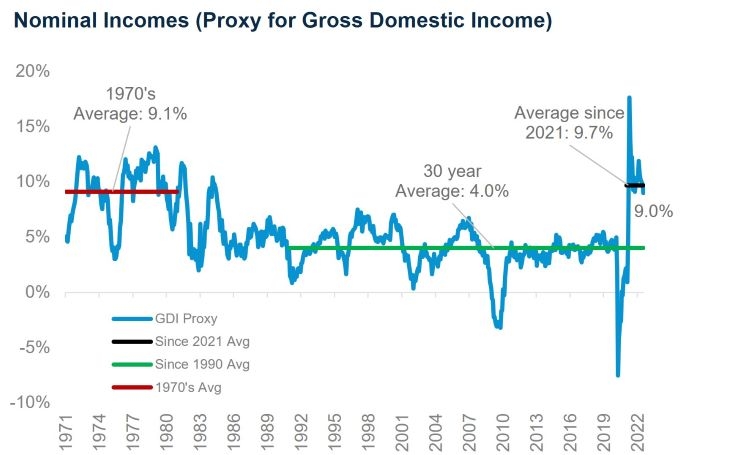

- For this month’s update, we focus on two things: 1) underlying growth momentum in the U.S. remains far too strong, and 2) this will challenge the Federal Reserve’s ability to bring down core inflation quickly.

- We look at the yearly growth in nominal incomes as a proxy for Gross Domestic Income (GDI). GDI is in theory identical to GDP but is calculated through aggregating incomes instead of expenditures. While GDI and GDP are theoretically identical, statistical measuring variances lead to short run differences between the two measures. We find GDI to be less “noisy” than GDP. Our GDI proxy looks at the combined yearly growth of employment, wages and hours worked. This GDI proxy is a good representation of underlying trend nominal GDP growth.

- In the 1970’s, nominal incomes grew 9.1% on average, which compares to the average over the last 30 years of 4.0%. The average growth rate since 2021 has been 9.7% (MAST, August 2022). Clearly, nominal incomes are too high and creating persistent inflationary pressures. This problem can only be alleviated in one way – a non-trivial growth slowdown that leads to higher unemployment and lower wage growth. This outcome has historically been associated with recession.

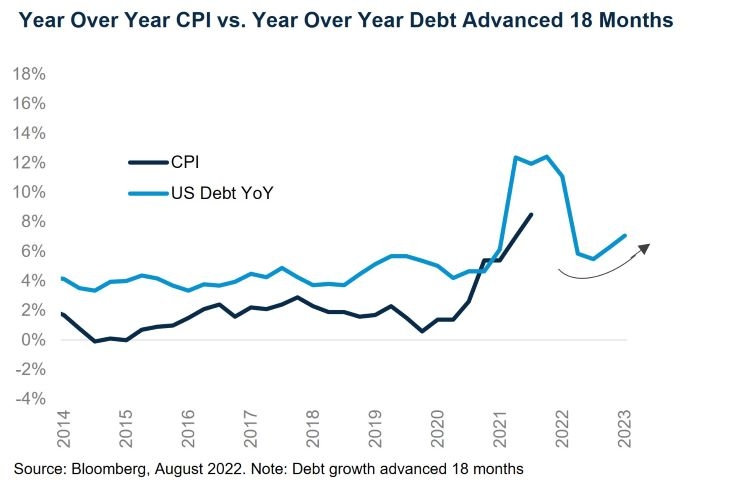

- To make matters worse, we’re back to an environment of accelerating debt growth in the U.S. (and abroad if you consider recent fiscal stimulus announcements in the UK and Germany to shield consumers from higher energy prices). The excess fiscal stimulus in 2020 and particularly 2021 is a key driver of the current inflation crisis, and growing credit will only add to aggregate demand and make inflation that much stickier.

- We continue to believe that the Federal Reserve and other Central Banks will remain resilient in the face of inflation. We also think that core services inflation, driven largely by wage growth, will be much more challenging to overcome than many think. Markets are not yet compensating us enough to put on risk, but we are on the look out for opportunities.

Source: MAST, August 2022

Important Information

For Institutional use only.

The views expressed herein are those of the Harbor Multi Asset Solutions Team at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. These views are not necessarily those of the Harbor Investment Team and should not be construed as such. The information provided is for informational purposes only.

Past performance is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

2706783

Locate Your Harbor Consultant

INSTITUTIONAL INVESTORS ONLY: Please enter your zip code to locate an Investment Consultant.