Multi-Asset Solutions Team Market Insights

Key Takeaways:

- Second quarter earnings seasons will be pivotal as we are on the cusp of an earnings downgrade cycle.

- Consensus bottom-up estimates are expecting a 10% increase in revenue and 5% earnings growth.

- Early reporters’ commentary on current business conditions remains positive, but conviction levels are waning.

- The analyst community is focused on if current trends can be extrapolated due to shifting economic momentum.

Flirting with Fate

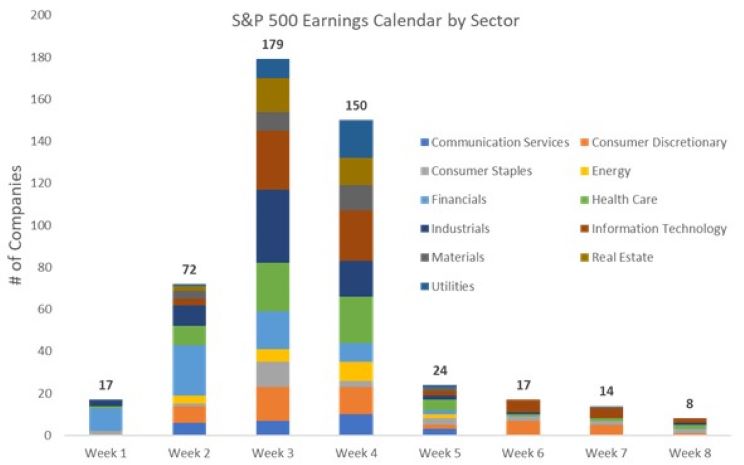

This week marks the unofficial start of earnings season, with 17 S&P 500 companies reporting. This will be a pivotal earnings season as we are on the precipice of an earnings downgrade cycle. Economic momentum is slowing at a rapid pace. The housing sector is softening, June New Orders entered a contractionary level, retail inventories are elevated, and commodities have peaked – signaling demand destruction.

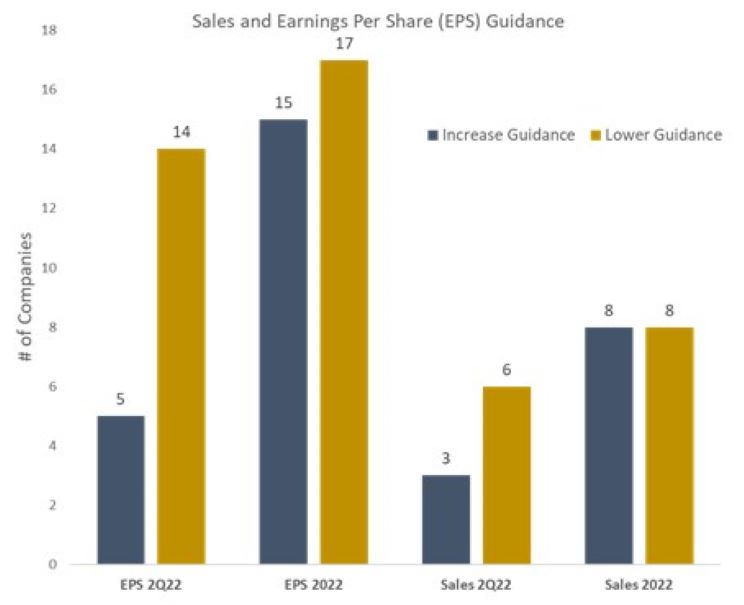

Companies that reported at the tail end of last earnings season, such as Walmart and Target, had a more cautious tone than the businesses that reported earlier - signaling that the economic environment was beginning to shift. Since then, we have had several companies lower guidance, notably Snap Inc., Target, and Restoration Hardware. For every company that has positively preannounced for the second quarter, three companies have lowered their outlooks. This is the highest rate of negative preannouncements since the beginning of the pandemic.

Earnings season will ramp up over the next few weeks, with companies representing a broad swath of the economy reporting results. This quarter our main themes of interest are the strength of the consumer, pivots in business confidence, labor dynamics, supply chains, and pricing actions. Additionally, given the bearish investor sentiment and positioning, we are keenly focused on how stocks respond to any deterioration in management’s outlook for their businesses.

Source: FactSet Estimates, Harbor Capital

Source: FactSet Estimates, Harbor Capital

2Q22 Earnings Review:

Consensus bottoms up estimates for the quarter have set the bogey mark at 10% revenue growth and 5% earnings growth. The second quarter sales and growth estimates are going up against the most challenging comparisons from a year ago when revenue grew 25%, and earnings rose 91% (S&P 500, July 2022).

Contribution to earnings growth is disparate across sectors, with the Energy sector contributing nine points to growth, while the Financials and Consumer Discretionary are detracting a combined six points (S&P 500, July 2022). Banks are building reserves due to higher loan growth and a weaker economic outlook than last year when they released the reserves built during the pandemic. This dynamic is driving a significant portion of the negative earnings contribution from the sector.

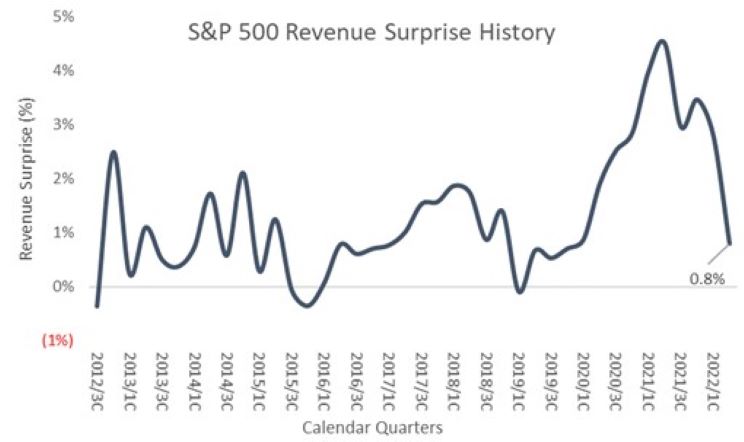

The early read in earnings season has shown softening in company fundamentals relative to expectations. With 7% of the S&P 500 having reported earnings so far, revenues have been in line with estimates, and profits have surprised slightly to the downside. The rate of surprises has fallen sharply as the economic cycle continues to mature. Furthermore, the past few quarters have seen the percentage of companies beating on both the top and bottom line fall from 75-80% to 60% (S&P 500, July 2022) so far this earnings season.

Source: FactSet Estimates, Harbor Capital

Source: FactSet Estimates, Harbor Capital

Source: FactSet Estimates, Harbor Capital

Source: FactSet Estimates, Harbor Capital

Learnings from Earnings:

The Multi-Asset Solutions Team monitors a portfolio of industry bellwethers’ earnings reports to extract insights into the underlying economic variables we track in our Business Cycle Indicator. Our micro-to-macro process provides a boots-on-the-ground perspective of fundamental trends impacting economic momentum.

Management commentary early in the earnings season has remained constructive, but conviction is waning. JP Morgan Chase, the largest banking institution in the United States, reported on Thursday, July 14th, and gave an update on what they experienced within their business. The company continues to see a strong consumer with combined debit and credit card spending up 15%. Additionally, consumers continue to spend in discretionary categories, with travel and dining expenditures up 34%. This was confirmed by Delta Airlines, which noted accelerating momentum through the June quarter and domestic consumer revenue ahead of 2019. Jamie Dimon said that the consumer is spending 30% more than pre-COVID and they are in better shape now than in 2008 and going into the pandemic. Consumers have more income and savings, balance sheets are healthier, and jobs are plentiful.

Per JP Morgan, the change from prior quarters related to the consumer was commentary that spending on gasoline has increased 35% YoY and recurring bills are 6% higher. With spending growing faster than income, the consumer has been forced to dip into their savings with the median deposit balance down across all income segments. Lastly, credit conditions overall remain at historical lows. However, we could be seeing early warning signs with early delinquencies rising in the low-income cohort.

Similarly, the read on business confidence thus far has been positive. JP Morgan noted that average loan growth across the organization was up 7% versus last year and increased 2% sequentially. Specifically, the business is seeing higher C&I revolver utilization and new account originations. Delta Airlines is also experiencing a recovery in business demand, with corporate volumes up 65%. According to a Morgan Stanley global corporate travel survey, respondents expect travel volumes to improve to 84% of 2019 levels in the second half of this year. Travel & Entertainment intentions is an excellent early indicator as it’s typically one of the first line items to be cut by corporations when business uncertainty rises. Lastly, Fastenal Co., a leading “just in time” distributor to the manufacturing sector, has great insight into spot demand. According to the company, the second quarter performance was strong, and customer backlogs are in excellent shape. However, the business leaders highlighted that while absolute business levels remain strong, business conditions weakened into the end of the quarter. During May and June, 72% of their branches were growing vs. 76% in April, and particular end markets saw weaker demand, specifically consumer and construction markets.

After listening to several earnings calls, it has been notable the stark difference between the tone of management’s prepared remarks and the focus of the analyst community’s questions. Business leaders have highlighted that business conditions remain robust. However, analysts’ questions have been centered around the economic momentum slowing and rising risk of recession. The contrast in views is symbolic of the undergoing of a phase transition. Based on past Natural Language Processing research examining the sentiment of earnings calls transcripts, there is more predictive power in the Q&A portion of a call transcript compared to the well-scripted prepared remarks. Given the negative sentiment around Q&A, this quarter relative to past quarters would support the view that broad-based negative earnings revisions are approaching.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

Performance data shown represents past performance and is no guarantee of future results.

Forecast and estimates are based on hypothetical assumptions and for informational purposes only. This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy. The information presented does not represent the results that any particular investor may actually attain. Actual results will differ, and may differ substantially, from the hypothetical information provided.

Indices listed are unmanaged, and unless otherwise noted, do not reflect fees and expenses and are not available for direct investment.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

2331218

Locate Your Harbor Consultant

INSTITUTIONAL INVESTORS ONLY: Please enter your zip code to locate an Investment Consultant.