Should Cash Become Your Core? Lessons from History

Interest rates have risen to a level where cash-like equivalent instruments (Treasury Bills, money market funds, high yield savings accounts, etc.) now offer attractive yields for the first time in years. This may cause some investors to wonder if they are better off investing in equivalent instruments rather than adding to their core bond allocation.

We believe that investors should resist that temptation. In our view, core and core plus bonds are currently more attractive than cash equivalents for a couple of reasons. First, there is no guarantee that attractive short-term rates will persist. Secondly, we believe that core and core plus bond managers have the potential to outperform short term instruments over the long run, given the diverse opportunity set available to managers in their pursuit of alpha. The opportunities within market segments such as corporate bonds and mortgage-backed securities provide meaningful sources of added value for core bond funds.

We believe that investors should resist that temptation. In our view, core and core plus bonds are currently more attractive than cash equivalents for a couple of reasons. First, there is no guarantee that attractive short-term rates will persist. Secondly, we believe that core and core plus bond managers have the potential to outperform short term instruments over the long run, given the diverse opportunity set available to managers in their pursuit of alpha. The opportunities within market segments such as corporate bonds and mortgage-backed securities provide meaningful sources of added value for core bond funds.

We believe that history supports our view. We looked back at previous periods when the 3-month Treasury bill yield exceeded 5% and compared their subsequent long-term total returns to the Bloomberg US Aggregate Bond Index (a standard proxy for intermediate-term bond funds).

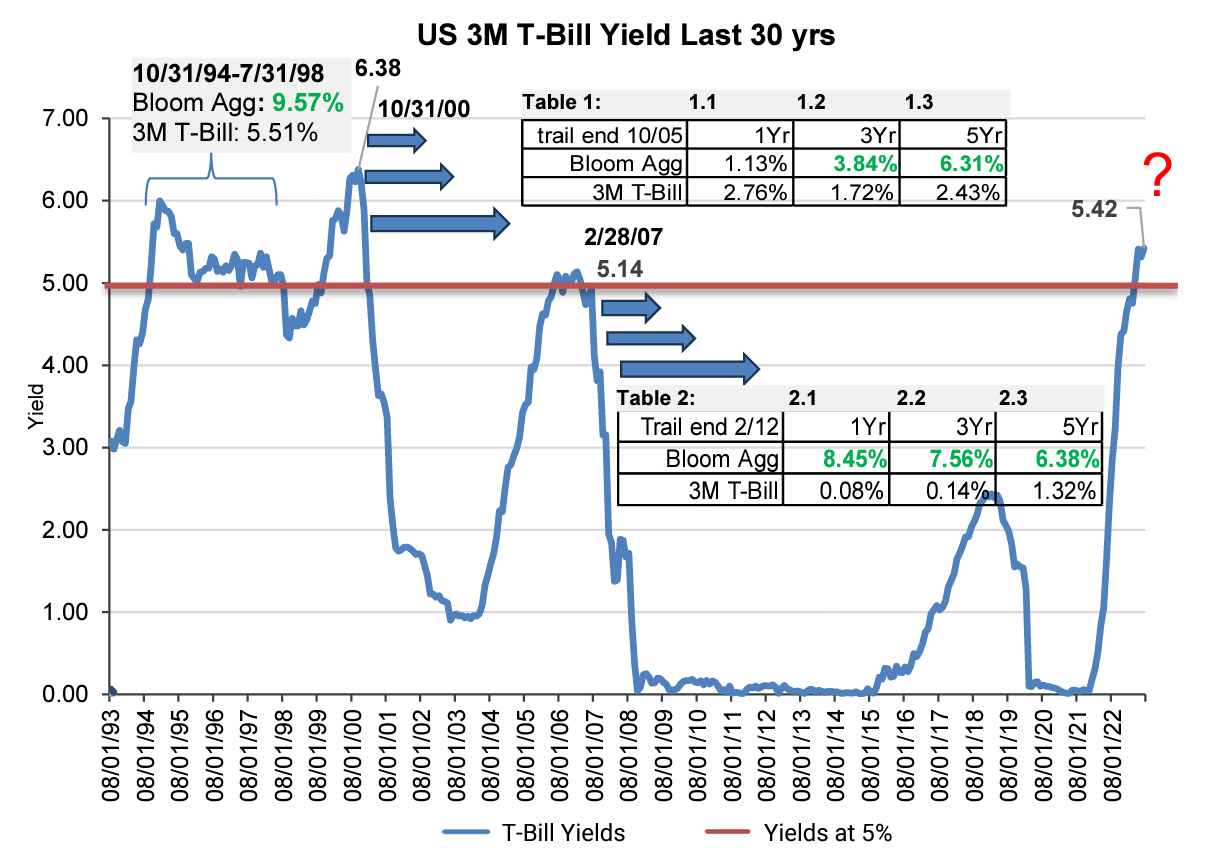

The chart below plots the 3-month T-Bill yield over the past 30 years. You can clearly see how quickly the T-bill yield has risen over the last year as the Federal Reserve has tightened monetary policy, lifting the Federal Funds rate to 5.5%. Prior to this, the 3-month T-Bill has yielded more than 5% three separate times over the last 30 years – between late 1994 and mid-1998, late 2000, and then early 2007.

Source: FactSet and Morningstar Direct as of August 31, 2023. Performance data shown represents past performance and is no guarantee of future results.

Source: FactSet and Morningstar Direct as of August 31, 2023. Performance data shown represents past performance and is no guarantee of future results.For the period between October 1994 through July 1998 when T-bill yields were consistently north of 5%, unsurprisingly, the 3-month T-Bill returned 5.51% annualized. However, over this same period, the Bloomberg US Aggregate Bond Index returned almost twice as much, at 9.57%.

Table 1 and 2 overlaying the chart above compare long-term returns for the other two brief periods where the 3-month T-Bill eclipsed a 5% yield. Table 1 shows returns following October 31, 2000. Although the 3-month T-Bill outperformed the Bloomberg US Aggregate Bond Index for the subsequent 1-year period (1.1), it trailed significantly both in the 3-year period (1.2) and 5-year period (1.3) out from October 31, 2000.

Table 2 shows the period following February 2007 when the 3-month T-Bill briefly yielded more than 5%. You can see that the Bloomberg US Aggregate Bond Index outperformed T-Bills by 8.37%, 7.42%, and 5.06% over the 1-, 3-, and 5-year periods respectively as the Fed’s accommodative policy post the Great Financial Crisis put downward pressure on short-term rates (2.1-2.3). While we’re not predicting that short rates are likely to crater towards zero as they did following the GFC in 2008, the fact that the 3-year return of the 3-month T-Bill was basically zero (0.14% ending 2/28/2010) when its starting yield was 5.14%, highlights how quickly “cash can become trash” when short rates fall.

In short, if history is any guide, investors could likely be better off sticking with core and core plus bond funds in their long-term portfolios rather than succumbing to the temptation of today’s higher cash rates.

Important Information

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice or a recommendation to purchase or sell a particular security.

There is no guarantee that the investment objective of the Fund will be achieved. Fixed income investments are affected by interest rate changes and the creditworthiness of the issues held by the Fund. As interest rates rise, the values of fixed income securities held by the Fund are likely to decrease and reduce the value of the Fund's portfolio. There may be a greater risk that the Fund could lose money due to prepayment and extension risks because the Fund invests, at times, in mortgage-related and/or asset backed securities.

Alpha is a measure of risk (beta)-adjusted return.

A corporate bond is a bond issued by a corporation in order to raise financing.

A mortgage-backed security is a type of asset-backed security which is secured by a mortgage or collection of mortgages.

A Treasury bill (T-Bill) is a short-term U.S. government debt obligation backed by the Treasury Department with a maturity of one year or less.

Intermediate term mortgage-backed securities typically have a durations between 4 and 10 years.

Short Treasuries have a maturity date no greater than 12 months.

Diversification does not assure a profit or protect against loss in a declining market.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of investment-grade fixed-rate debt issues with maturities of at least one year. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Trail end is the number attached referencing the most recently completed time period of specified length.

Income Research + Management is an independent subadvisor to the Harbor Core Bond Fund and Harbor Core Plus Fund.

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

Distributed by Harbor Funds Distributors, Inc.

3129982

Locate Your Harbor Consultant

INSTITUTIONAL INVESTORS ONLY: Please enter your zip code to locate an Investment Consultant.