The Case for Duration Neutrality

In the current “lower for longer” yield environment, we have seen many active core bond managers and investors overweight their portfolios to lower duration securities in anticipation of rising rates.

- This approach may make sense intuitively, but has it worked historically?

- How difficult is it to effectively make portfolio decisions based on rate forecasting?

- How can active managers insulate their portfolios and potentially mitigate some of the negative impacts of rising rates on bond prices?

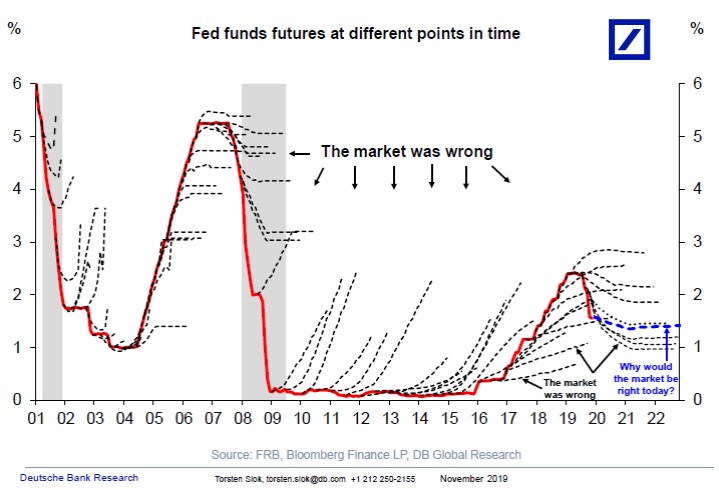

Forecasting Interest Rate Changes has been very difficult historically

Accurately and consistently forecasting the direction of interest rates across the yield curve has historically proven to be a tall order. As an example, within the Federal Funds markets, actual federal funds rates have often been significantly different than, and often directionally opposite from Fed funds futures rates. As such, a long-term, duration neutral approach to core bond investing may provide a better solution for bond managers and investors alike.

During a period of rising rates, there are two potential ways to dampen the price declines of a duration neutral portfolio versus the overall market*:

- Maintain an overweight position to corporate bonds

- Maintain a more positive convexity profile

*As defined by the Bloomberg Barclays U.S. Aggregate Bond Index

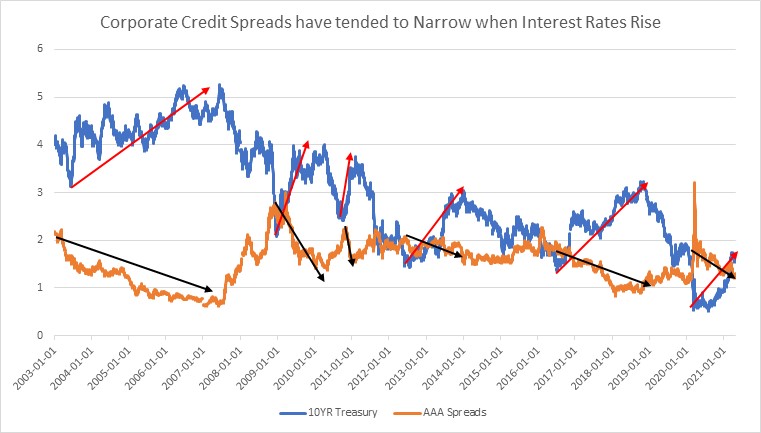

Corporate credit spreads often tighten in periods of rising interest rates and widen in periods of falling rates

For example, In the wake of the credit crisis as well as the global pandemic, the Federal Reserve dramatically reduced interest rates to stimulate the economy. At the same time, spreads widened dramatically between treasury and corporate bond yields as investors sought the safety of treasury bonds.

The opposite has proven to be true during periods of rising rates. A rise in treasury yields is often a sign of economic growth. As treasury rates have risen historically and as investors have become more comfortable with adding incremental risk, corporate credit spreads have often narrowed.

Interest Rate Changes & Corporate Credit Spreads (2003 – 2021)

Source: FactSet

As such, long-term strategies that maintain a more duration neutral posture but are buoyed by a relative overweight to credit and other less rate sensitive sectors of the market versus the Bloomberg Barclays U.S. Aggregate Bond Index, may stand to benefit during periods of rising rates. They have the advantage of not only avoiding potentially incorrect yield bets, but also enhanced total return potential from the offset of spread tightening, rising bond values, and the incremental reinvestment in bonds with higher yields relative to low yielding, shorter duration securities.

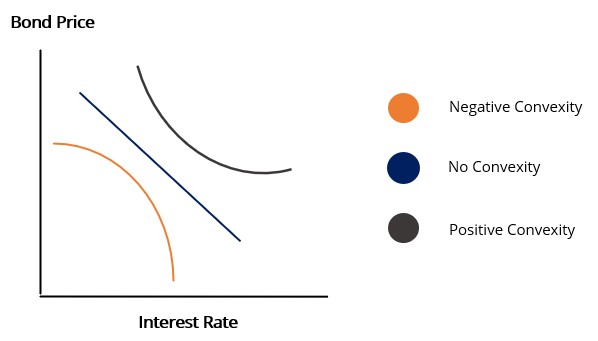

Positive Convexity is also attractive in a rising rate environment

Source: Corporate Finance Institute

Fixed income securities display convexity based on how their prices behave to changes in interest rates. Positive convexity is considered attractive for a fixed income security because it implies that the bond’s price will increase at an increasing rate as interest rates fall and will decline at a decreasing rate as interest rates rise. Conversely, some bonds, like mortgage backed securities, can exhibit negative convexity, where prices decline at an increasing rate as interest rates rise because the duration of these securities lengthens as issuers are less likely to make prepayments or refinance in the future.

As such, core bond strategies that can maintain a more positive convexity profile vs the benchmark (Bloomberg Barclays Aggregate Bond Index), can potentially experience smaller bond price declines in periods of rising rates.

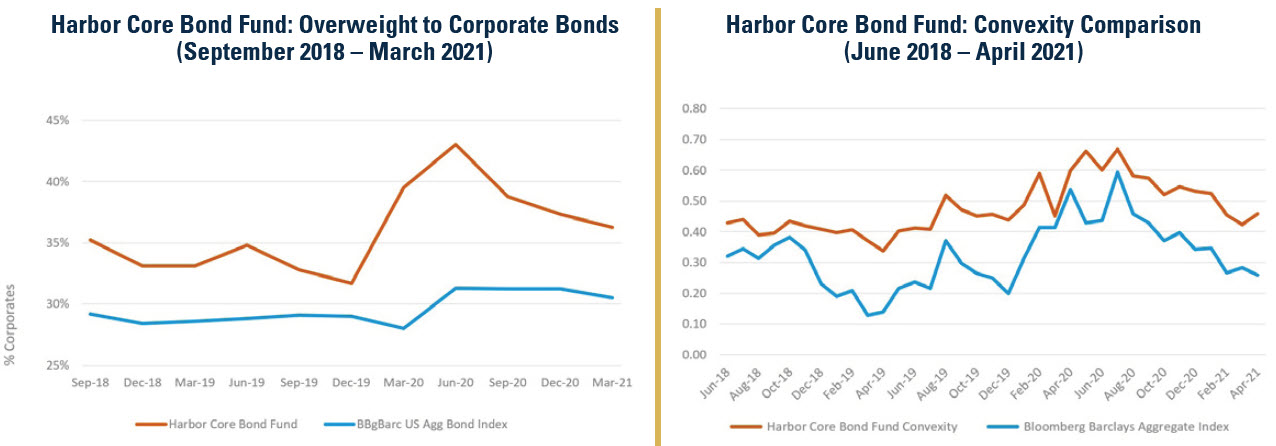

The Harbor Core Bond Fund has historically been overweight to both Corporates and Convexity vs the Benchmark

While historically maintaining a duration neutral profile to the benchmark, the Harbor Core Bond Fund has also maintained a consistent overweight to corporate bonds as well as a consistently more positive convexity profile.

Source: IR&M, Bloomberg Barclays

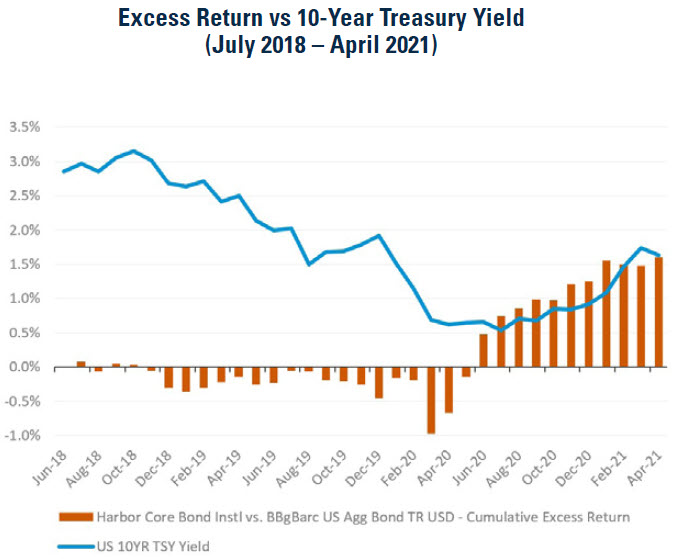

The net effect of duration neutrality, active sector positioning, active security selection, and net positive convexity has led to attractive alpha generation as interest rates have risen over the last several months.

Source: Morningstar Direct & FactSet Research Systems

Income Research + Management

Income Research + Management (IR+M) believes in the case for duration neutrality when constructing their core fixed income portfolios. They do not make directional bets based on macro factors or forecasted changes in the yield curve. They also believe in the structural advantages of optimal portfolio construction and active security selection.

Income Research + Management is a privately-owned, independent, fixed income investment management firm that serves institutional and private clients. They believe that an open, collaborative culture promotes excellence from an investment team of high energy, curious individuals. IR+M’s investment philosophy and process are based on their belief that careful security selection and active risk management provide superior results over the long-term. By combining the capacity and technology of a larger firm with the culture and nimbleness of a boutique firm, the firm strives to provide exceptional service for their clients and a rewarding experience for their employees.

The Harbor Core Bond Fund

Sub-advised and managed by Income Research + Management (IR+M)

What sets Harbor Core Bond Fund apart?

- Aware, but not constrained. The bottom-up security selection process seeks to add value by rotating between sectors based on relative value. The portfolio managers are aware of the benchmark, but not constrained by it, and take the opportunities that the market offers. Purchase and sell decisions focus on fundamental credit analysis, security structure and price relative to other opportunities. See less

- Discipline leads to concentration. Their team-oriented investment decision-making process is disciplined, repeatable, and based on a core foundation of bottom-up research. That process supports a duration- and curve-neutral portfolio that typically contains less than 200 securities and is therefore more concentrated than many peers. See less

- Stable, experienced and independent. IR+M is a privately-owned, independent, fixed income investment manager, with over 30 years of experience serving private and institutional clients. The investment team has experience managing through various credit cycles. All members of IR+M's Management Committee and senior portfolio managers have ownership in the firm, and are dedicated to its success

For more information on the Harbor Core Bond Fund, please visit Harbor Core Bond Fund.

Legal Notices & Disclosures

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice.

The information provided in this presentation is for informational purposes only. The information provided in this presentation should not be considered as a recommendation to purchase or sell a particular security. The weightings, holdings, industries, sectors, and countries mentioned may change at any time and may not represent current or future investments.

©2021 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborfunds.com or call 800-422-1050. Read it carefully before investing.

Income Research + Management is an independent subadviser to the Harbor Core Bond Fund.

Distributed by Harbor Funds Distributors, Inc.

For Institutional Use Only – Not For Distribution to the Public

Locate Your Harbor Consultant

INSTITUTIONAL INVESTORS ONLY: Please enter your zip code to locate an Investment Consultant.