Asset Allocation Viewpoints & Positioning Q1 2021 Update

Approaching “Peak Growth”

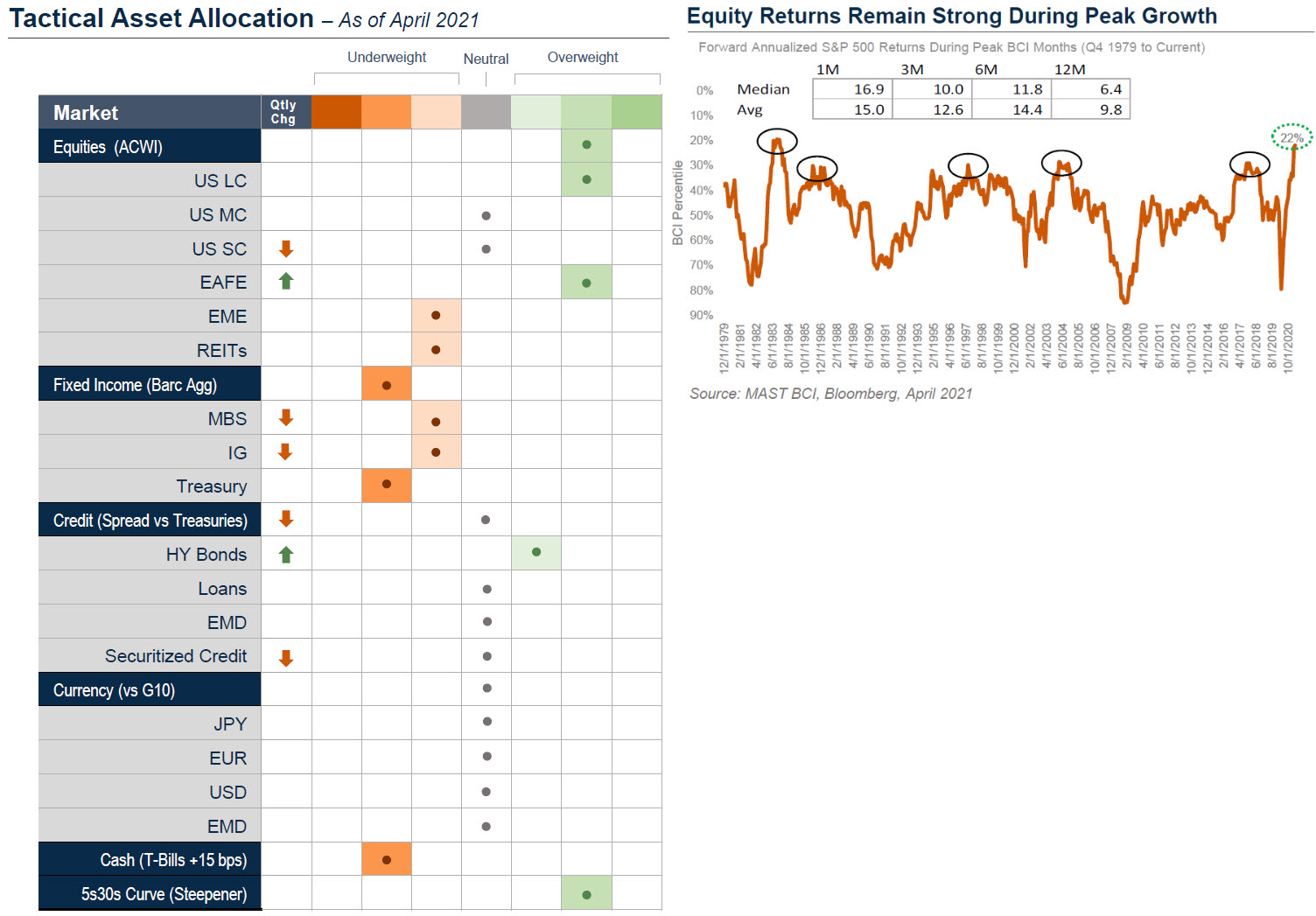

We retain our equity overweight and increase our value cyclical tilt

Update to the Q1 2021 Asset Allocation Viewpoints

Updated Perspectives

- Equities perform well during “peak growth” periods (when our business cycle index improves beyond 30%tile); we remain overweight equities funded from duration

- Vaccinations in the U.S., UK and Western Europe continue to progress at a favorable pace with ~30% of the EU population having received at least one shot, ~46% in the U.S., and ~53% in the UK

- We believe that reopening economies, the Fed looking through near term inflation, $2.0T in stimulus passed in March, and ~$2.0T in elevated consumer savings will drive further gains in risk assets

- We expect both growth and inflation to continue accelerating higher throughout the year (adjusting for mid year base effects); we therefore lower small cap to neutral to fund an increase to our EAFE overweight which we view as a beneficiary to reflation; we view U.S. and EAFE cyclical value as cheap against a favorable macro backdrop and thus we also increase our allocations to cyclical value in both regions

Legal Notices & Disclosures

The views expressed herein are those of the Harbor Multi Asset Solutions Team at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. These views are not necessarily those of the Harbor Investment Team and should not be construed as such. The information provided is for informational purposes only.

Past performance is no guarantee of future results.

The information shown relates to the past. Past performance is not a guide to the future. The value of an investment can go down as well as up. Investing involves risks including loss of principal.

All investments are subject to market risk, including the possible loss of principal. Stock prices can fall because of weakness in the broad market, a particular industry, or specific holdings. Bonds may decline in response to rising interest rates, a credit rating downgrade or failure of the issue to make timely payments of interest or principal. International investments can be riskier than U.S. investments due to the adverse affects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets.

Fixed income securities fluctuate in price in response to various factors, including changes in interest rates, changes in market conditions and issuer-specific events, and the value of an investment may go down. This means potential to lose money.

As interest rates rise, the values of fixed income securities are likely to decrease and reduce the value of a portfolio. Securities with longer durations tend to be more sensitive to changes in interest rates and are usually more volatile than securities with shorter durations. Interest rates in the U.S. are near historic lows, which may increase exposure to risks associated with rising rates. Additionally, rising interest rates may lead to increased redemptions, increased volatility and decreased liquidity in the fixed income markets.

2706783

Locate Your Harbor Consultant

INSTITUTIONAL INVESTORS ONLY: Please enter your zip code to locate an Investment Consultant.