Asset Allocation Viewpoints & Positioning - May 2021

Keeping Sight of the Forest Rather Than the Trees

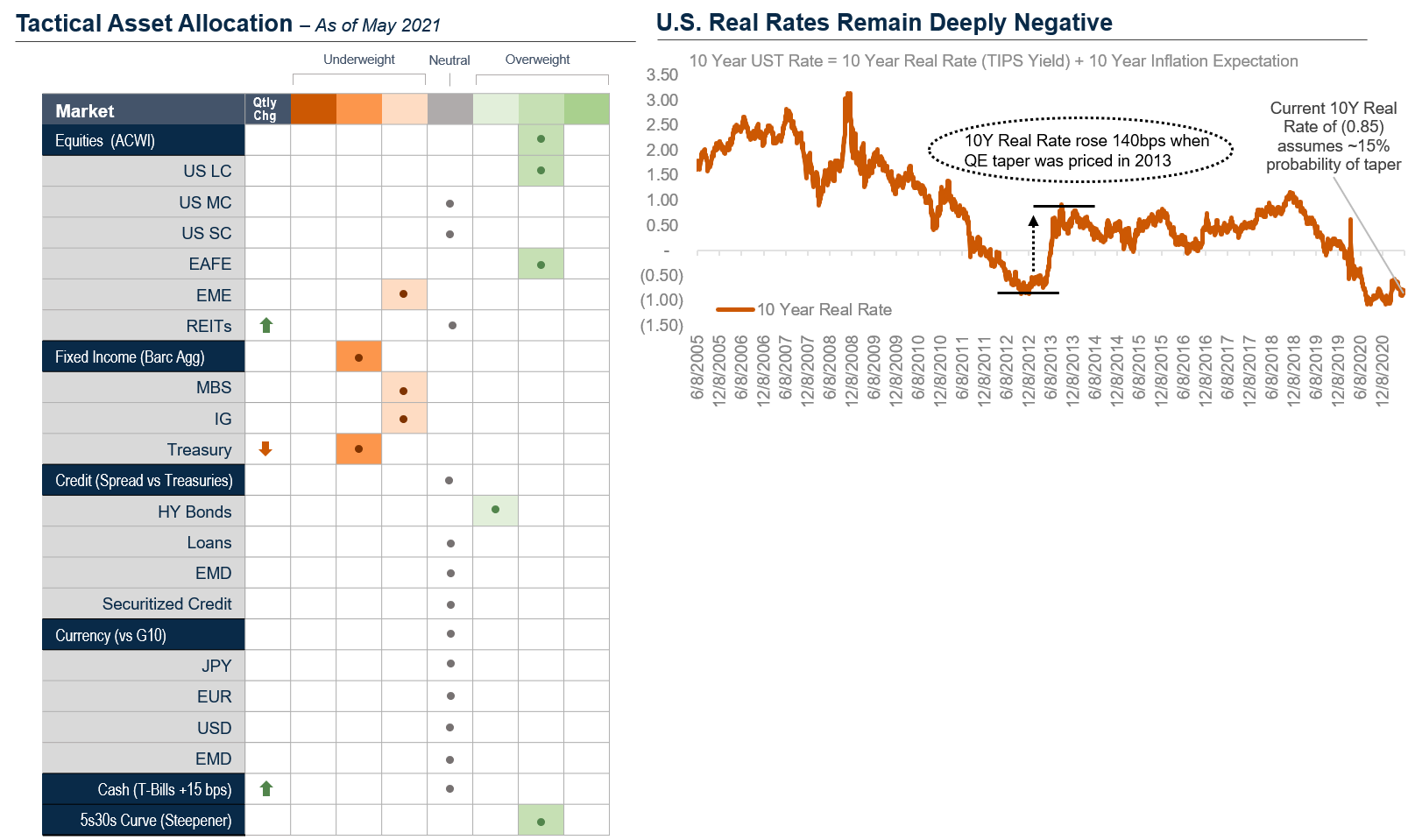

We retain our pro-cyclical tilt due to above-trend growth, rising interest rates, and further upward EPS revisions

May 2021 update to the Q1 2021 Asset Allocation Viewpoints

Updated Perspectives

- The macro backdrop remains very positive for risk assets as growth continues to organically accelerate in the U.S. and Europe on the back of successful vaccination campaigns and economic reopening. We bring down duration further, upgrade our view on REITs to neutral and raise cash.

- Vaccinations in the U.S., UK and Western Europe continue to progress at a favorable pace with ~43% of the EU population having received at least one shot, ~51% in the U.S., and ~60% in the UK.

- We expect mid single digit equity returns through year end driven by further upward earnings revisions; we continue to forecast that S&P 500 EPS for 2022 will revise higher by at least another 5%. We see more upside to cyclical value stocks in both the U.S. and EAFE relative to long duration growth equities.

- Policy remains an important catalyst for our view. We currently estimate that the bond market is pricing in just a 15% probability of QE taper; we expect the market to gradually shift towards pricing in a higher probability in the U.S. which will cause nominal rates to rise driven by real rates (TIPS yield).

Updated Perspectives: How we’re positioning for inflation, tapering and the Fed:

- We believe the economy is currently experiencing peak inflation acceleration for 2021 from transitory factors that will likely dissipate. We think inflation will then reaccelerate in 2022 from more fundamental factors such as the strong monetary impulse we’ve experienced since Q1 2020, the closing of the output gap, and improving labor market conditions. Much of this is priced in, however, with the 5yr breakeven priced for ~2.3% inflation.

- We do not know precisely when the Fed will formally announce QE tapering as it will depend on the employment numbers between now and year end, but we believe that the conversation around tapering only increases from here and our base case is that it begins in Q1 of 2022. We think markets still have a significant amount to price in for this and see real rates rising to at least 0bps from -85bps currently.

- During Q1 of this year, the market quickly began to price an earlier QE taper than the Fed had been communicating, so we saw real rates rise dramatically (+50bps) and lift nominal rates (+60bps). Value cyclicals outperformed strongly, and long duration growth pulled back along with China and EM. The USD also strengthened. The Fed pushed back on this and in April the market began to pull back its expectations on tapering. Real rates fell and brought down nominal rates, long duration growth rebounded, and the USD weakened. We believe this retracement was a head fake as real rates rise later this year and begin to price in a greater probability for QE taper.

- We view the Fed’s policy around taper and interest rates as very important for positioning not just in terms of duration, but also more broadly within equities. We think the two most important variables that will drive the Fed’s reaction function will be employment gains and inflation through the remainder of the year. Our current inflation forecast calls for core CPI to reach roughly 2.5% by the middle of next year assuming all transitory supply chain and labor issues are resolved. Bond markets are mostly pricing this in. This is precisely what the Fed wants to see, both in terms of core inflation overshooting 2.0%, but also in terms of markets anticipating higher inflation which becomes a self-fulfilling prophecy.

- That leaves us with employment. We believe employment gains are currently being held back primarily due to elevated unemployment benefits. Nearly half of the states in the US have begun to pull back on their excess unemployment benefits, and we think that will catalyze accelerating employment growth from here. The augmented unemployment benefit program will expire in September and lead to further job gain acceleration in Q4. Even if we discard this likely scenario and assume that job gains persist at the same rate as the trailing three-month average of +539k jobs, that would result in 3.8M new jobs created by the end of the year. The U.S. economy is currently ~7.5M jobs below prior pandemic employment levels. That would reduce the unemployed population by half, which we believe qualifies for the kind of “substantial progress” the Fed is looking for to justify QE tapering.

- In terms of positioning, we believe maintaining an equity overweight coupled with a cyclical value overweight within equities, all funded from duration, nicely hedges both risks of a more violent response in rates markets to tapering and also inflation overshooting. If the Fed surprises the market with overly hawkish rhetoric around tapering, or if inflation overshoots and does not appear to be transitory, then we would expect equities to pull back shorter term while value cyclicals outperform. If the inverse happens, and the Fed is more dovish than we expect or if inflation underwhelms, then we would expect equities to outperform by a larger magnitude and value cyclicals to pull back shorter term. We therefore believe this positioning hedges us to near-term taper and inflation risk, meanwhile over the next 6-12 months we expect both equities and value cyclicals to outperform.

Legal Notices & Disclosures

The views expressed herein are those of the Harbor Multi Asset Solutions Team at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. These views are not necessarily those of the Harbor Investment Team and should not be construed as such. The information provided is for informational purposes only.

Past performance is no guarantee of future results.

The information shown relates to the past. Past performance is not a guide to the future. The value of an investment can go down as well as up. Investing involves risks including loss of principal.

All investments are subject to market risk, including the possible loss of principal. Stock prices can fall because of weakness in the broad market, a particular industry, or specific holdings. Bonds may decline in response to rising interest rates, a credit rating downgrade or failure of the issue to make timely payments of interest or principal. International investments can be riskier than U.S. investments due to the adverse affects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets.

Fixed income securities fluctuate in price in response to various factors, including changes in interest rates, changes in market conditions and issuer-specific events, and the value of an investment may go down. This means potential to lose money.

As interest rates rise, the values of fixed income securities are likely to decrease and reduce the value of a portfolio. Securities with longer durations tend to be more sensitive to changes in interest rates and are usually more volatile than securities with shorter durations. Interest rates in the U.S. are near historic lows, which may increase exposure to risks associated with rising rates. Additionally, rising interest rates may lead to increased redemptions, increased volatility and decreased liquidity in the fixed income markets.

2706783

Locate Your Harbor Consultant

INSTITUTIONAL INVESTORS ONLY: Please enter your zip code to locate an Investment Consultant.